Bitcoin halving, also known as “The Halvening”, is a highly anticipated event in the world of cryptocurrency. It occurs approximately every four years and involves a significant reduction in mining rewards. Together, we will delve into the intricacies of Bitcoin halving, its impact on the market, and how it affects the future of Bitcoin.

Table of Contents

Understanding Bitcoin’s Supply Limit

In order to understand the concept of Bitcoin halving, it is essential to grasp the underlying principle of Bitcoin’s supply limit. Bitcoin was designed with scarcity in mind, with a fixed supply of 21 million coins. Scarcity sets it apart from traditional fiat currencies, which are printed at will by the central banks. Satoshi Nakamoto, the enigmatic creator of Bitcoin, believed that a limited supply would imbue the digital currency with inherent value.

The Bitcoin Halving Process

Bitcoin halving is an integral part of the cryptocurrency’s design. It involves reducing the number of new bitcoins entering circulation by half. Reduction occurs every 210,000 blocks, which is roughly every four years. The event is programmed into Bitcoin’s code and will continue until the year 2140, when the 64th and final halving is projected to take place.

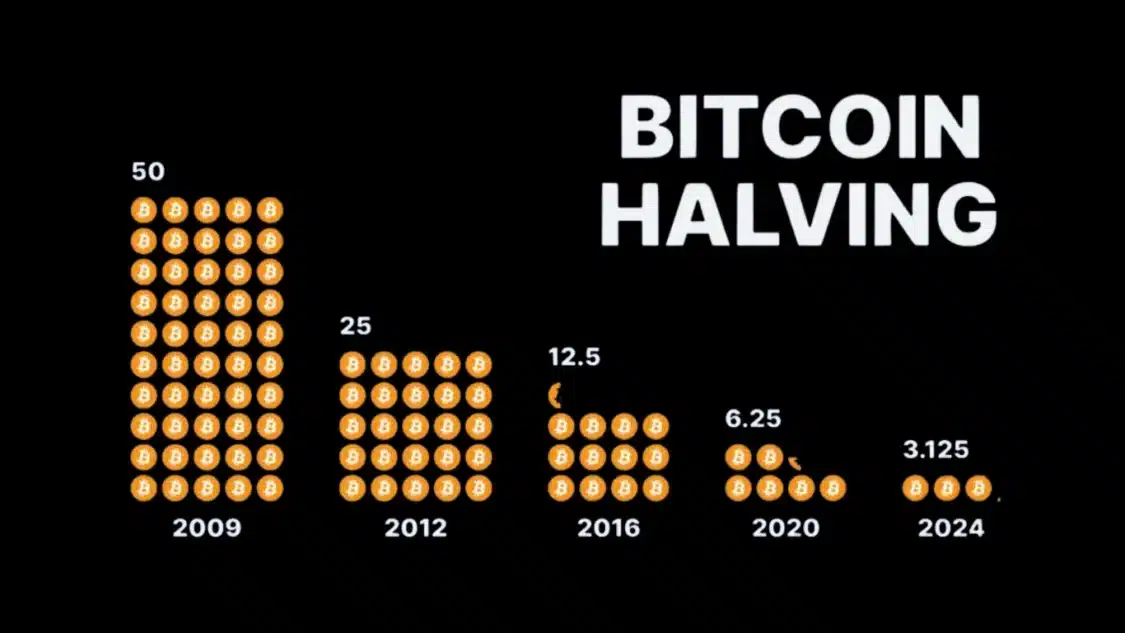

Let’s take a brief look at the history of bitcoin halving:

- The first halving occurred in 2012, reducing mining rewards from 50 BTC to 25 BTC per block.

- The second halving took place in 2016, further reducing rewards to 12.5 BTC per block.

- The most recent halving occurred in 2020, cutting rewards to 6.25 BTC per block.

- The next halving is expected to happen in 2024, reducing rewards to 3.125 BTC per block.

The Significance of Halving

Bitcoin halving is not merely a market event but has profound implications for the underlying economic incentives and security of the Bitcoin network. By reducing mining rewards, halving gradually limits the rate at which new bitcoins are generated. This scarcity and controlled supply contribute to Bitcoin’s value proposition as a deflationary asset.

Key reasons for the occurrence of bitcoin halving are as follows:

- Scarcity and Controlled Supply: Bitcoin’s limited supply creates scarcity, making it a valuable asset over time. The controlled issuance of new coins ensures that the supply remains constrained and predictable.

- Inflation Control: Halving helps prevent excessive inflation in the Bitcoin ecosystem by decreasing the rate at which new bitcoins enter the market. The limited issuance process aims to maintain the long-term stability and value of the cryptocurrency.

- Market Forces and Economics: The halving event has economic implications for miners and the overall market. Miners must adapt their operations to remain profitable with reduced block rewards, leading to increased competition and potential consolidation within the mining ecosystem.

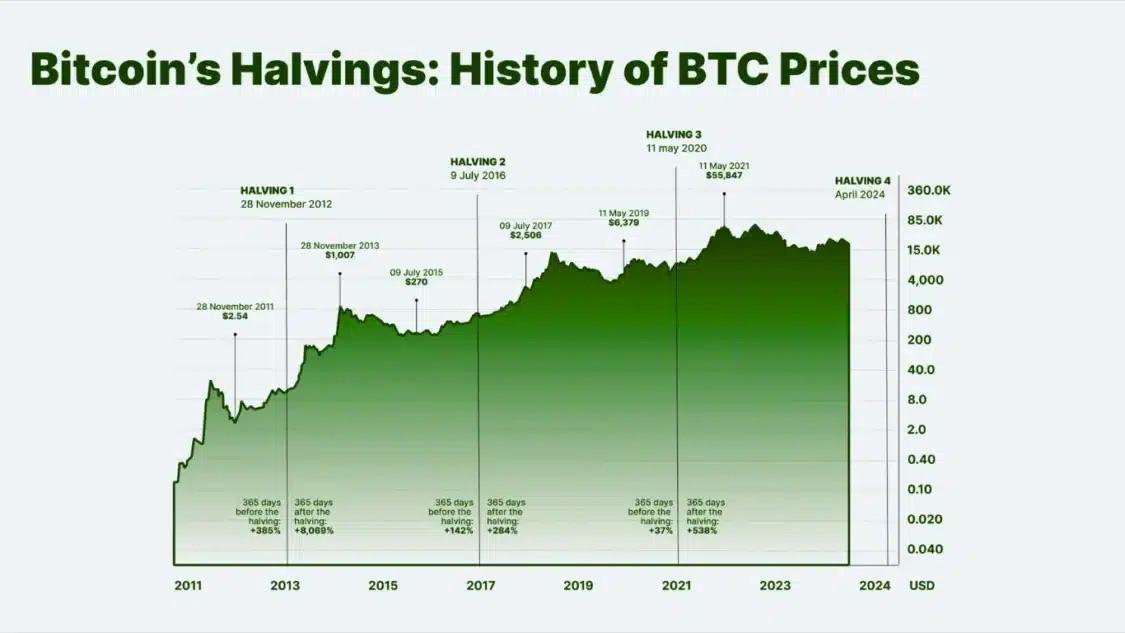

- Price Impact: Historically, bitcoin halving events have often been associated with price increases. The expectation of decreased supply and potential rising demand can result in positive market sentiment and price appreciation. However, it is crucial to note that various factors influence Bitcoin’s price, and past performance does not guarantee future results.

The Impact on Bitcoin Miners

Bitcoin miners have a critical responsibility to uphold the security, decentralization, and reliability of the Bitcoin network. Miners validate transactions and connect them to the blockchain; they require specialized mining hardware and electricity, resulting in significant investments. Halving impacts the miners directly as their rewards are reduced, which can make it challenging for them to maintain profitability.

As the block rewards diminish over time, miners need to adapt to the changing dynamics of the mining environment. With reduced incentives, smaller miners may face difficulties and potentially drop out of the industry. This concentration of mining power among larger players can impact the decentralization and security of the network.

Additionally, as the mining rewards approach zero, miners will primarily rely on transaction fees to sustain their operations. Currently, transaction fees make up a small percentage of a miner’s revenue, but their significance is expected to grow as the reward mechanism shifts. The transition from rewards to transaction fees highlights the evolving economic dynamics of the Bitcoin ecosystem.

The Price Impact of Bitcoin Halving

One of the most debated topics surrounding Bitcoin halving is its potential impact on the price of Bitcoin. While some argue that halving events are already priced into the market, others believe that reduced supply could drive up demand and subsequently increase the price of Bitcoin.

Examining past halving events can provide insights into potential price movements:

- The 2012 halving resulted in a significant price increase for Bitcoin, with the price rising from around $660 to over $20,000 by the end of 2017.

- Following the 2016 halving, Bitcoin’s price initially remained relatively stable but eventually experienced a substantial bull run, reaching an all-time high of over $27,000 by the end of 2020.

It is important to note that other factors, such as market sentiment, adoption by institutional investors, and macroeconomic conditions, can also influence Bitcoin’s price. While halving events may contribute to price appreciation, they are not the sole determinant.

The Future of Bitcoin and Bitcoin Halving

Bitcoin halving will continue to shape the future of Bitcoin as it approaches the ultimate supply limit of 21 million coins. As the halving rewards decrease, the network will rely increasingly on transaction fees to incentivize miners and secure the blockchain. This transition highlights the ongoing evolution and maturity of the Bitcoin ecosystem.

It is worth mentioning that the Bitcoin protocol is not set in stone, and future changes to the reward mechanism or consensus algorithm are possible. As the cryptocurrency landscape evolves, alternative consensus mechanisms, such as proof-of-stake, may gain prominence. However, any significant changes to Bitcoin’s core protocol would require widespread consensus among the community, making them challenging to implement.

Frequently Asked Questions (FAQ)

-

When is the next Bitcoin halving?

The Bitcoin halving is expected to occur in 2024, which will reduce mining rewards to 3.125 BTC per block.

-

How does Bitcoin halving affect the price of BTC?

Historically, Bitcoin halving events have caused price increases because the reduced rate of new Bitcoin creation can cause scarcity, potentially driving up demand and price.

-

How many Bitcoins are left to be mined?

As of now, approximately 19 million Bitcoins are in circulation, leaving around 2 million yet to be mined.

-

When will all the Bitcoins be mined?

All Bitcoins will be mined in the 64th and final halving event in 2140.

-

Does Ethereum halve like Bitcoin?

“Ethereum Triple Halving” is a mechanism inspired by Bitcoin’s halving that causes three factors, leading to deflationary pressure on the ETH supply.

Conclusion

Bitcoin halving is a very important event in the cryptocurrency world, with far-reaching implications for the market and the future of Bitcoin. By reducing the at which new bitcoins enter circulation, halving contributes to the scarcity and value proposition of the digital asset. The impact on miners, market dynamics, and price movements make it a subject of great interest and speculation.

As Bitcoin continues to mature and evolve, halving will remain a pivotal aspect of its monetary policy and economic incentives. Understanding the intricacies of halving is crucial for investors, enthusiasts, and anyone interested in the dynamics of the cryptocurrency market. While past halving events provide valuable insights, it is essential to approach future predictions with caution, considering the multifaceted factors that influence Bitcoin’s price.