Derivatives are financial products whose value depends on an underlying asset. Debt, equity securities, commodities, indices, and currencies are typical examples of these assets. They can derive their value from almost any underlying asset.

The derivative in this example is the contract, and the underlying asset is the resource up for purchase. If the value of the asset rises over time, the business saves money. If the asset drops or rises less than anticipated, the business will lose money. For this reason, companies use derivatives to their advantage to lock in the price of the products they need for production in future cases. By doing so, they don’t have to worry about the rise and fall of raw materials.

There are different types of derivatives. Certain types can help manage risk by locking the underlying asset’s price. For example, a company that relies on a specific resource to function may enter into a contract alongside a supplier to purchase that resource a month in advance at a fixed price. If the resource has a market value that fluctuates frequently, the company can lock in a price for a set period.

What can derivatives be used for?

They are most often used to purchase commodities such as copper, sugar, oil, and wheat, and have two purposes. One is a speculative tool, and the other is to prevent risk. In most cases, derivatives require advanced trading. Such as speculating, options, hedging, swaps, futures contracts, and forward contracts.

What types of derivatives are there?

There are a few places to purchase derivatives. One is through a broker under “exchange-traded” or a standardized contract. Another option is over-the-counter, nonstandard contracts. Let’s review the types available:

Future Contracts

Future contracts are primarily traded in commodity markets. Futures contracts represent an agreement to purchase commodities at a pre-set price for a specific date.

Forward Contracts

Like futures contracts, forward contracts are given a set date and price. They are nonstandardized and are traded over the contract. The two parties involved can modify the details to suit their needs. The one thing they have different from future contracts is that they don’t settle daily but at the set expiration date or end date.

Options

They grant the right to buy or sell a specific asset for a predetermined price by a specific date. Options are primarily traded as standardized contracts on exchanges like the Chicago Board Options Exchange or the International Securities Exchange. As an individual trader, options can be risky.

Swaps

Swaps are derivative contracts that minimize risk. Companies, financial institutions, and banks are organizations that usually enter swaps. There are two derivatives categories: interest rate swaps and currency swaps. To reduce the risk, they can change a fixed rate debt into a floating rate debt and the other way around. In addition, they can make it challenging to pay a debt in another country’s currency by minimizing the chance of a currency move.

Swaps can have a significant impact on the balance sheet. They are designed to balance and stabilize cash flows, assets, and liabilities.

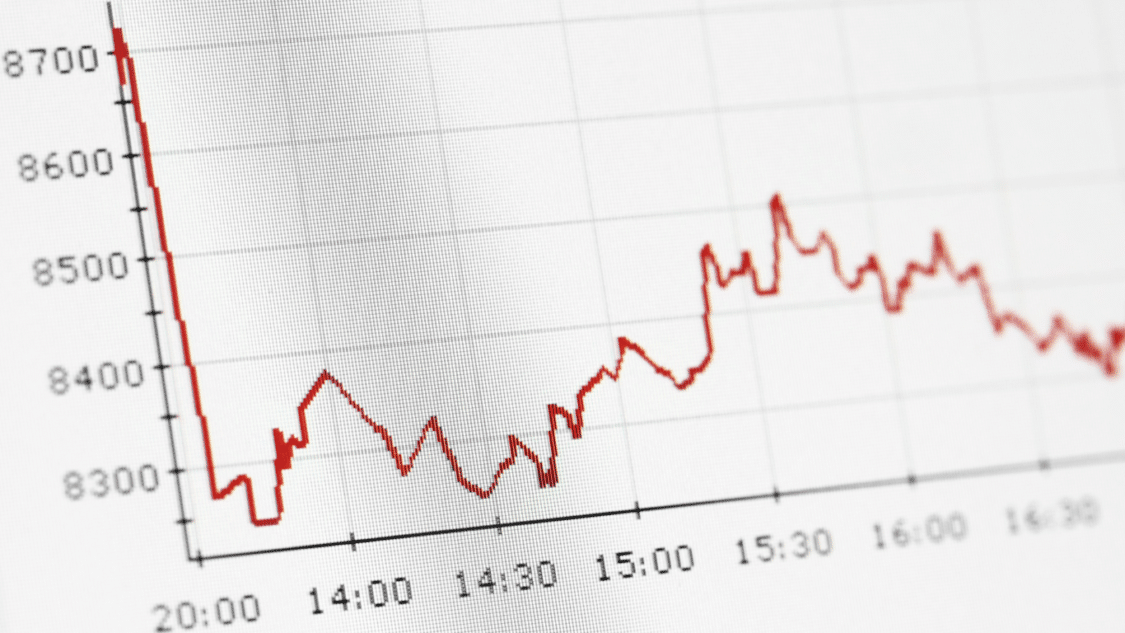

What risks are involved in derivatives?

There is a lack of transparency regarding the notion of derivatives, which can often cause institutions to go bankrupt. In addition, there is a counterparty risk that derivatives carry along with them. As mentioned above, most derivatives count on an additional side of the trade. If they can’t complete their end of the deal, the other side loses financially.

Leverage is purchasing investments with borrowed funds. Banks and other institutions can carry large amounts of derivative positions on their books when there is leverage in order to enter complicated derivative arrangements. If the market or counterparty involved underperforms, the contract is then not worth much.

Since many privately written derivative contracts include built-in collateral calls, the problem could worsen. These involve a counterparty that helps financially when there is distress which can only cause problems that can potentially lead to bankruptcy. Therefore many corporations, individual investors, and the economy itself are often by derivative losses.

Derivatives Regulation: Understanding the History and Evolution

Derivatives are monetary rebellious whose esteem is inferred from a fundamental resource or gathering of resources. They have become an essential part of modern financial markets, with the potential to both mitigate and amplify risk. However, derivatives trading can also pose significant risks to the stability of financial markets, which is why regulatory oversight is crucial.

History of Derivatives Regulation

The origin of the regulation of derivatives can be seen from the period of the Great Depression in the 1930s. The United States of America. In 1933 and 1934, the United States Congress enacted the Securities Act and the Securities Exchange Act, respectively. Establishing the Securities and Exchange Commission (SEC) to regulate securities trading and prevent fraud. These laws also required companies to disclose information about their financial condition, including their use of derivatives.

In the 1970s, financial innovation led to new derivatives products, such as futures and options contracts.

Commodity Futures Trading Commission was founded in 1974 to regulate these markets. The CFTC had the authority to oversee exchange-traded and over-the-counter (OTC) derivatives markets.

In the 1980s and 1990s, the use of derivatives grew exponentially, and regulators needed help to keep up with the pace of innovation. In 1998, the collapse of the hedge fund Long-Term Capital Management (LTCM) highlighted the systemic risks of derivatives. The U.S. Congress responded by passing the Commodity Futures Modernization Act of 2000, which exempted many OTC derivatives from regulation.

The Global Financial Crisis of 2008 exposed weaknesses in the regulatory framework for derivatives. Complex derivatives, such as credit default swaps, played a significant role in the crisis. In response, the U.S. Congress passed the reform Dodd-Frank Wall Street and Consumer Protection Act in 2010. Dodd-Frank established new rules for trading, clearing, and reporting derivatives, including the requirement for standardized derivatives to be traded on exchanges or electronic platforms.

Evolution of Derivatives Regulation

Since the financial crisis, regulators worldwide have continued to refine and strengthen the regulatory framework for derivatives. In 2013, the G20 nations agreed to a series of reforms to improve transparency and reduce risk in derivatives markets. These reforms included the requirement for standardization and central clearing of certain derivatives.

The Australian Securities and Investments Commission (ASIC) is responsible for regulating derivatives trading. ASIC’s regulatory framework aims to promote fair and transparent markets and protect investors. The framework includes licensing requirements for derivatives issuers and intermediaries and rules governing trading, disclosure, and reporting.

What are the current regulations surrounding derivatives trading and how do they impact traders and investors?

Regulatory Bodies and Frameworks

Derivatives trading is subject to various regulatory bodies and frameworks, depending on the type of derivative, the market where it is traded, and the jurisdiction where it is issued or traded. Some of the regulatory bodies and frameworks are:

- Securities and Exchange Commission (SEC): regulates securities and derivatives trading in the United States, including exchange-traded options and futures, security-based swaps, and security-based swap agreements.

- Commodity Futures Trading Commission (CFTC): regulates futures, options, swaps, and other derivatives traded on U.S. exchanges or OTC markets, including energy, metals, agricultural, and financial derivatives.

- European Securities and Markets Authority (ESMA): controls the regulation of derivatives trading in the European Union (EU), including the European Market Infrastructure Regulation (EMIR), which requires central clearing and reporting of certain derivatives, and the Markets in Financial Instruments Directive (MiFID II), which sets out rules for transparency, investor protection, and competition.

- International Organization of Securities Commissions (IOSCO): coordinates the regulatory oversight of securities and derivatives markets among national authorities and develops principles and standards for regulating derivatives.

Regulatory Requirements and Compliance

Derivatives trading involves various regulatory requirements and compliance obligations that traders and investors need to be aware of, such as:

- Licensing and registration: issuers and intermediaries of derivatives may need to obtain licenses or registrations from regulatory bodies and comply with ongoing reporting and disclosure requirements.

- Clearing and settlement: many derivatives are subject to mandatory clearing and settlement requirements, which aim to reduce counterparty and systemic risks by centralizing the processing and collateralization of trades.

- Margin and collateral: derivatives trading may require posting initial margin and variation margin, which are deposits or securities that traders and investors must provide as collateral to cover potential losses.

- Reporting and disclosure: derivatives trading may require the reporting of trades, positions, and valuations to regulatory bodies or trade repositories, as well as the disclosure of information to counterparties or investors.

Impact on Traders and Investors

The impact of derivatives trading regulations on traders and investors can be positive and negative, depending on factors such as the type of derivative, market conditions, and regulatory compliance costs. Some of the potential impacts are:

- Increased transparency and risk management: regulatory requirements such as central clearing, reporting, and disclosure can increase the transparency and risk management of derivatives trading and reduce the potential for market abuse or manipulation.

- Higher costs and barriers to entry: regulatory compliance can entail higher costs and barriers to entry for traders and investors, especially for smaller or less sophisticated ones, who may need to rely on intermediaries or technology providers to meet the regulatory requirements.

- Reduced innovation and liquidity: some critics argue that excessive or rigid regulation can stifle innovation and liquidity in derivatives markets and lead to market fragmentation or concentration.

For more news updates, visit our homepage now and see our latest news article. Want to learn more about trading? Visit our education page now and learn for FREE!

What you need to know about Penny Stocks(Opens in a new browser tab)

Short Term and Long-Term Investments(Opens in a new browser tab)