The Stochastic Oscillator is an indicator that compares the closing price of an asset to the range of its prices over a certain period. It measures the location of the close relative to the high-low range and is expressed as a percentage. It is ranges from around 0 to 100, and readings above 80 are considered overbought, while readings below 20 are considered oversold. The indicator is used to determine potential turning points in the market and is often used in conjunction with other technical indicators.

How does a Stochastic Oscillator work?

The Stochastic Oscillator compares a security’s closing price to its price range over a specified number of periods, usually 14. The resulting value is then expressed as a percentage, with values ranging from 0 to 100.

A reading above 80 indicates that the security is overbought, meaning its price has risen too quickly and may be due for a pullback. Conversely, a reading below 20 indicates that the security is oversold, meaning its price has fallen too rapidly and may be scheduled for a rebound.

It also has a signal line, a moving average of the Oscillator, and is used to generate buy and sell signals. A crossover of the signal line and the Oscillator is considered a potential buy or sell signal, depending on the direction of the crossover.

It’s important to note that while the Stochastic Oscillator can be a useful tool for traders, it should not be relied on as the sole indicator for making investment decisions. It’s best used with other technical analysis tools and market data.

What does the Stochastic Oscillator measure?

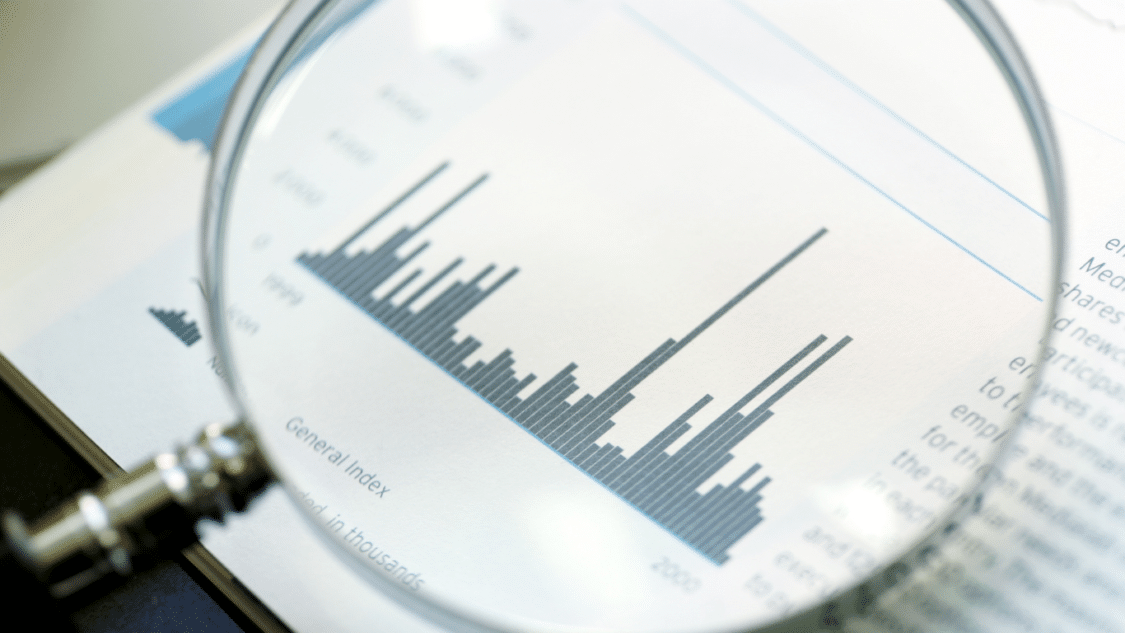

The Stochastic Oscillator measures the level of the closing price of a security relative to its price range over a specified number of periods. It determines whether a security is overbought or oversold and can be used as a momentum indicator. The Oscillator ranges from 0 to 100, with readings above 80 considered overbought and readings below 20 considered oversold. This information can be used to help traders make decisions about potential buying or selling opportunities. However, it’s essential to keep in mind that it should not be used as the sole indicator for making investment decisions and should be used hand in hand with other technical analysis tools and market data.

How do you read the Stochastic Oscillator?

To read a Stochastic Oscillator, you need to understand the following three key elements:

- The Oscillator Line: This line oscillates between 0 and 100. When the line is above 80, it indicates that the security is overbought, and when it is below 20, it indicates that the security is oversold. When the line rises, it shows that the security’s closing price is moving closer to its high, and when the line falls, it shows that the closing price is moving closer to its low.

- The Signal Line: This is a moving average of the Oscillator Line and is used to generate buy and sell signals. When the Oscillator Line passes the Signal Line, it generates a buy signal, and when the Oscillator Line goes below the Signal Line, it generates a sell signal.

- Overbought and Oversold Levels: These levels are represented by the 80 and 20 lines on the chart. When the Oscillator Line is above 80, it indicates that the security is overbought, and when it is below 20, it indicates that the security is oversold.

To use the Stochastic Oscillator, you would look for a crossover between the Oscillator Line and the Signal Line, as well as look for the Oscillator Line to reach overbought or oversold levels. These signals can provide information about potential buying or selling opportunities. However, it’s essential to keep in mind that the Stochastic Oscillator should not be used as the sole indicator for making investment decisions.

What are the limitations of a Stochastic Oscillator?

The Stochastic Oscillator, like all technical indicators, has limitations and should not be used as the sole basis for making investment decisions. Some of the limitations of the Stochastic Oscillator include the following:

- False signals: The Stochastic Oscillator can generate false signals, leading to incorrect buy and sell decisions. To mitigate this risk, it’s important to use the indicator in conjunction with other technical analysis tools and market data.

- Limited historical data: The Stochastic Oscillator is only as accurate as the historical data it uses, which may be limited in some markets.

- Lagging nature: The Stochastic Oscillator is a lagging indicator that only provides signals after a trend has already started. This can make it difficult to identify trends in real-time.

- Overbought and oversold levels are subjective: The 80 and 20 levels used to determine overbought and oversold levels are subjective and can vary based on market conditions.

- Limited ability to predict market bottoms: The Stochastic Oscillator is not designed to predict market bottoms, which can limit its usefulness as a long-term investment tool.

It’s important to keep these limitations in mind when using the Stochastic Oscillator and to use the indicator in conjunction with other tools and market data to make informed investment decisions.

What is the best setting for stochastic?

The best setting for the Stochastic Oscillator can vary depending on the security being traded and the individual trader’s trading style and goals. The two key settings for the Stochastic Oscillator are the %K period and the %D period.

For %K period, a common setting is 14, but some traders use shorter periods of 5 or 8 for more sensitive signals, while others use longer periods of 20 or 50 for a more smoothed and less volatile signal.

A common setting for the %D period is 3 or 9, but some traders use other values, such as 5 or 10, to match their preferred trade duration.

Ultimately, the best setting for the Stochastic Oscillator will depend on the trader’s goals, the market conditions, and the individual trader’s risk tolerance and comfort level. Traders should test different settings to see which works best for their particular trading style and market conditions.

It’s important to keep in mind that the Stochastic Oscillator should not be used as the sole basis for making investment decisions. It should be used in conjunction with other technical analysis tools and market data.

How to use a Stochastic Oscillator for intraday?

The Stochastic Oscillator can be used for intraday trading by looking for potential buy and sell signals generated by crossovers between the Oscillator Line and the Signal Line and monitoring the Oscillator Line’s position relative to the overbought and oversold levels.

Here’s how to use the Stochastic Oscillator for intraday trading:

- Set the period: Choose a period of time that is appropriate for the security you are trading. For intraday trading, a short-term period of 5-14 periods is commonly used.

- Monitor the Oscillator Line: Watch for the Oscillator Line to reach overbought levels above 80 or oversold levels below 20. These levels can indicate potential turning points in the market.

- Look for crossovers: When the Oscillator Line crosses above the Signal Line, it generates a buy signal, and when the Oscillator Line crosses below the Signal Line, it generates a sell signal.

- Confirm signals with other indicators: It’s important to confirm signals generated by the Stochastic Oscillator with other technical analysis tools and market data to increase the accuracy of your trades.

- Manage risk: When using the Stochastic Oscillator for intraday trading, it’s important to have a well-defined risk management strategy in place to minimize potential losses.

Keep in mind that while the Stochastic Oscillator can be a useful tool for intraday traders, it could be more accurate and can generate false signals. It’s important to use the indicator in conjunction with other technical analysis tools and market data to make informed trading decisions.

Unlock Your Trading Potential with These Top Forex Platforms of 2023