Binance, the world’s leading cryptocurrency exchange, has come under scrutiny due to regulatory pressures, lawsuits, and legal troubles faced by its founder. This isn’t the first time we’ve seen exchanges collapse in the cryptocurrency world. Just a year ago, we witnessed the downfall of Sam Bankman-Fried, who went from being an “innovative entrepreneur” to orchestrating one of the most significant financial scams in history.

Yet, this doesn’t mean that crypto is dead; it’s just getting rid of the bad actors. As history has shown, there will always be financial scams, and ironically, they sometimes occur in the most giant corporations. Now that two of the most prominent players in the game are out, the industry is puzzled: who will be next to shine, and what will be the next financial crisis in the industry?

Table of Contents

Brief History of Crypto Exchanges

In the dawn of the cryptocurrency era, the landscape resembled a lawless frontier — a terrain fraught with risk and devoid of regulation. The journey from those hazardous beginnings to the present day’s regulated, user-friendly exchanges is a fascinating one.

Acquiring Bitcoin in the Early Days

Bitcoin, the brainchild of the enigmatic Satoshi Nakamoto, was launched in 2009 with only two methods of acquisition available — self-mining or peer-to-peer (P2P) trades via forums like Bitcointalk.

Bitcoin mining

In Bitcoin’s infancy, mining was far less demanding in terms of computational power and could be conducted on personal computers. However, it still required technical know-how.

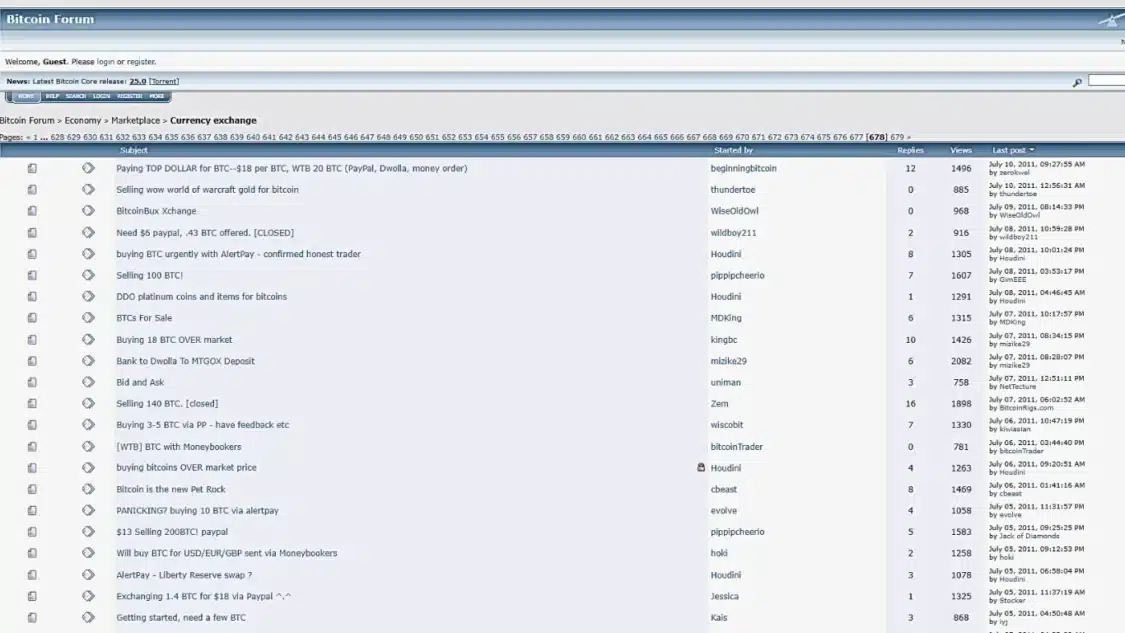

Peer-to-Peer Trading

P2P trading posed its challenges, as it involved a considerable degree of trust between parties. At this time, Bitcoin had negligible value, yet the stakes escalated as its worth gradually increased.

The Emergence of Bitcoin Exchanges

As interest in Bitcoin grew, new modes of acquisition surfaced. Bitcoin core developer Gavin Andresen established a Bitcoin “faucet” — a website that gifted five Bitcoins to anyone with a Bitcoin address. This marked the beginning of Bitcoin exchanges.

Bitcoin Market

Bitcoin Market was announced on Bitcointalk in 2010 and was among the first exchanges. It offered a floating exchange rate for Bitcoin and provided a platform for users to buy Bitcoin via PayPal.

Photo: Bitcointalk

Mt. Gox

Mt. Gox was initially an exchange for Magic: The Gathering cards, but it was pivoted to a Bitcoin exchange under the stewardship of Jed McCaleb. The platform went on to gain notoriety in the later years.

Mt. Gox Under New Ownership

Mt. Gox underwent a significant transition in 2011 when Mark Karpeles, a software developer, acquired it from McCaleb. Still, the platform soon faced a massive hack, leading to a significant drop in Bitcoin prices.

The Mt. Gox Hack

The Mt. Gox hack in 2014 was a significant event in the history of crypto exchanges. Users faced significant delays in withdrawals, and the platform had to suspend trading. It was later revealed that Mt. Gox had lost around $460 million worth of Bitcoin due to the hack.

The Rise of New Exchanges

The following years saw the emergence of many new exchanges. VirWoX facilitated trades between Linden Dollars (Second Life’s virtual currency) and Bitcoin, while Tradehill enabled users to purchase Bitcoin instantly.

What is TradeHill?

VirWoX was an early exchange that allowed users to exchange fiat currency for Bitcoin. It started operating in 2007 as a marketplace where users could convert virtual tokens from online games into fiat currency. In April 2014, VirWoX added Bitcoin exchange services. Initially, VirWoX users could use fiat currency through PayPal to buy virtual tokens for the games and then convert them to Bitcoin. Though it was permanently closed in 2020.

What is VirVox?

VirWoX was an early exchange that allowed users to exchange fiat currency for Bitcoin. It started operating in 2007 as a marketplace where users could convert virtual tokens from online games into fiat currency. In April 2014, VirWoX added Bitcoin exchange services. Initially, VirWoX users could use fiat currency through PayPal to buy virtual tokens for the games and then convert them to Bitcoin. Though it was permanently closed in 2020.

The Bitfinex hack

Bitfinex, a popular Hong Kong-based exchange, was a well-known name in the early Bitcoin ecosystem. In spite of that, it’s not just for its trading services that Bitfinex has earned fame. In 2016, it was at the centre of one of the most significant cryptocurrency heists in history, with hackers making off with nearly 120,000 Bitcoins. Today, this Bitcoin haul is valued at an astounding $3.7 billion. This article delves into the details of this colossal digital theft, its aftermath, and how Bitfinex managed to survive.

In August 2016, Bitfinex disclosed the alarming news of a security breach that had led to the theft of 119,756 Bitcoins, approximately $72 million in value at that time. The shockwaves of this announcement resulted in a rapid 20% plunge in Bitcoin value, briefly falling to around $480.

The collapse of FTX

FTX, which was one of the most well-known cryptocurrency exchanges, collapsed over a 10-day period in November 2022. The catalyst for this collapse was a scoop by the crypto news site CoinDesk on November 2nd. The article revealed that Alameda Research, a quantitative trading firm and sister company of FTX, held most of its assets in FTT and other tokens created and controlled by FTX and its insiders. This was in contrast to holding a fiat currency or cryptocurrency with a market-driven and time-tested value.

Following the revelations, investors and customers began to withdraw their funds from FTX, leading the exchange to become insolvent and declare bankruptcy. The situation raised concerns in the cryptocurrency industry that FTX was over-leveraged with Alameda Research, relied on precarious financial accounting metrics, and faced associated financial management risks.

According to anonymous sources cited by Reuters, it’s been cited that between $1 billion and $2 billion in customer funds were unaccounted for as of November 12th. The Financial Times has stated that FTX’s balance sheet showed $9 billion in liabilities before the bankruptcy, with $900 million in liquid assets, $5 billion held in “less liquid” assets, and $3.2 billion in illiquid private equity investments, making it not only one of the biggest crypto crashes but also one of the largest financial hoaxes in history.

Binance’s legal issues

At this moment, while we deal with the next financial crisis in the crypto market, another one is taking place. Binance, the world’s largest cryptocurrency exchange, has recently been in the news due to various regulatory pressures, lawsuits, and legal troubles plaguing its founder. The exchange is facing increased scrutiny from various regulatory bodies, including the United States SEC (Securities and Exchange Commission), which has initiated an investigation into its activities.

The lawsuits against Binance include allegations of market manipulation and insider trading. The legal troubles faced by its founder include charges of money laundering and tax evasion. These issues have led to concerns among investors and cryptocurrency enthusiasts alike, who are questioning the future of the exchange.

Many people are currently wondering whether Binance will be able to prevail over all these obstacles and continue to operate in the future. The exchange has been a major player in the cryptocurrency market, and its collapse could have significant implications for the industry as a whole. Only time will tell how this situation will play out.

What Will Be the Next Financial Crisis?

It is anticipated that following Binance’s downfall, many customers will seek out other exchanges, as has happened before with the examples we’ve cited in this article. Some of these firms may rise to become the next Binance, while others may meet the same fate as FTX. Here are the existing industry leaders who may find themselves insolvent if any disruptions occur:

OKX

OKX is a global cryptocurrency exchange offering both spot and derivatives trading. It is the second-largest crypto exchange by trading volume, serving over 50 million users worldwide. The exchange was founded in 2017 by Star Xu, who is also the CEO as of 2023.

The exchange operates in several global markets, including Hong Kong, the United Arab Emirates, the Bahamas, and France. OKX has offices in Dubai, Turkey, Hong Kong, Silicon Valley, Singapore, and Australia. In addition, OKX has partnerships with prestigious brands and sports teams such as Manchester City, McLaren, and the Australian Olympic Team. Since 2022, OKX has sponsored the Tribeca Film Festival and holds exclusivity for non-fungible token (NFT) marketplaces and cryptocurrency exchanges at Tribeca events.

OKX suffered from legal issues in Mainland China, and as of September 2021, it can’t offer any trading services in China.

Crypto.com

Crypto.com is a cryptocurrency exchange company based in Singapore. As of June 2023, the company reportedly had 80 million customers and 4,000 employees. The exchange issues its own exchange token, named Cronos.

The Singapore-based Crypto.com shut down institutional services on its platform in the U.S. in June 2023 due to the “current market landscape” that shows “limited demand” for its services. U.S. regulators’ recent assault on Binance and Coinbase, the biggest cryptocurrency exchanges in the world, likely played a pivotal role in the company’s decision to deprioritize and temporarily end its U.S. services for institutional clients; yet, just because they seem safe doesn’t mean the next financial crisis isn’t looming.

KuCoin

KuCoin is a platform for buying, selling, and trading a wide range of cryptocurrencies. It offers various investment options, such as staking and lending, as well as spot trading, margin trading, and futures trading. With a user-friendly interface and a global presence, KuCoin serves millions of customers in over 200 countries. The platform prioritizes security and transparency, using advanced encryption and storage systems to keep user assets safe.

KuCoin has been facing regulatory issues in multiple countries. The South Korean and Dutch regulators have accused the exchange of carrying out illegal business activities without proper registration. More recently, in March 2023, New York State Attorney General Letitia James prosecuted KuCoin, alleging that the Seychelles-based crypto exchange is violating securities laws by offering tokens, including Ether, that meet the definition of a security without registering with the attorney general’s office.

Coinbase

Coinbase is a publicly traded American company that operates a cryptocurrency exchange platform. It is the largest cryptocurrency exchange in the United States, with a high trading volume. The company was founded in 2012 by Fred Ehrsam and Brian Armstrong and operates on a distributed model with all employees working remotely. In May 2020, Coinbase announced that it would close its San Francisco headquarters and shift to a remote-first approach, following a trend initiated by several other major tech companies in response to the COVID-19 pandemic.

Although cryptocurrencies can offer anonymous trading, Coinbase trades are not anonymous. Registered users are required to provide their taxpayer identification, and all transactions are reported to the IRS. Additionally, despite offering more than 250 different cryptocurrencies to US customers as of 2023, Coinbase does not trade Monero and other cryptocurrencies with enhanced anonymity protection due to KYC requirements in accordance with anti-money laundering regulations.

Will the next financial crisis in crypto will come from Coinbase? The SEC has filed a complaint against Coinbase, accusing the company of illegally facilitating the buying and selling of crypto asset securities and making billions of dollars through these activities. According to the SEC, Coinbase has been operating as an exchange, broker, and clearing agency without registering any of these functions with the Commission, which is required by law.

According to the complaint filed against Coinbase, it is alleged that the platform offers a marketplace for trading securities, processes securities transactions on behalf of its customers, and provides tools for comparing data related to the terms of settlement of crypto asset securities transactions. The SEC has accused Coinbase of failing to register, which has adversely affected investors by depriving them of essential protections such as inspection by the SEC, record-keeping requirements, and safeguards against conflicts of interest, among others.

Kraken

Kraken Crypto Exchange is a San Francisco-based cryptocurrency exchange that allows users to trade cryptocurrencies using the US dollar, Canadian dollar, euro, and Japanese yen. Yet again, the US Securities and Exchange Commission (SEC) recently filed a lawsuit against Kraken, alleging that the exchange violated federal securities laws.

The SEC claimed that Kraken operated as an unregistered broker, clearing agency, and dealer. Moreover, the regulator accused the company of commingling customer and corporate funds, which created a “significant risk” by mixing up to $33 billion in customer crypto with its own corporate assets. These allegations are similar to the SEC’s past suits against other crypto trading platforms, and legal issues might create the next financial crisis in the cryptocurrency industry.

Gate.io

Gate.io was hacked and exploited several more times, one of which was done by an attacker who got his hands on a private key to take advantage of the upgrade function of the smart contract that drives the network (in this case, the PAID network). In this hack, almost 60 million PAID tokens worth $166 million were stolen at the time.

Another hack occurred in 2019 when the Ethereum Classic (ETC) network was attacked in a 51% attack, and $271,500 worth of tokens were stolen, but $100,000 of it was recovered by one of the hackers.

The team behind Gate.io is unknown, and the arena operates without a licence. On October 5, 2021, China completely banned its activities along with other digital currency trading platforms and services. As a result, there is a possibility that the next financial crisis in crypto could originate from Gate.io.

Huboi

Huobi Global, a well-known cryptocurrency exchange, is currently facing significant challenges on several fronts. These include a trademark dispute, allegations of fraud against a key person, and an order to cease operations in Malaysia.

On March 22, the U.S. Securities and Exchange Commission (SEC) charged Justin Sun, the actual owner of Huobi, with fraud and violating securities laws.

The problems for Huobi Global were further compounded on May 22 when the company was ordered to halt its operations in Malaysia. This order adds to the increased scrutiny that cryptocurrency exchanges are currently facing.It is expected to have a significant impact on Huobi’s future operations and its position in the market, potentially leading to the next financial crisis in the crypto industry.

MEXC

MEXC Global, known previously as MXC, is a centralised cryptocurrency exchange that offers digital trading services. The company was founded in 2018, and the team behind it is located in various countries, such as Singapore and the Seychelles. MEXC Global’s platform is accessible in over 170 countries, and as the platform gains more clients, the possibility of legal issues arising is also increasing. It remains to be seen if MEXC will be affected by the next financial crisis in the industry.

The Learning Curve: Security and Compliance

The numerous hacks and security breaches served as wake-up calls for exchanges. They realised the importance of security and the necessity of adhering to regulations.

Initially, exchanges paid little heed to registration or compliance with KYC( Know Your Customer), Anti-Money Laundering (AML), and counter-terrorism financing (CFT) laws. This led to Bitcoin being associated with nefarious activities.

Nevertheless, this scenario has changed, with exchanges in major markets like the United States, Europe, and parts of Asia now being regulated. This has helped improve Bitcoin’s image from a currency for criminal enterprises to the future of money.

Final Thoughts

To conclude, the collapse of FTX and the impending downfall of Binance have significantly impacted the crypto industry ecosystem and will continue to do so, given their dominance in the field. Moreover, it has also highlighted the fact that the size of these exchanges does not guarantee immunity from legal scrutiny or misconduct.

As history has shown us, new players have always emerged to replace the former ones, irrespective of their size and market share. While we can only speculate about the direction of the next financial crisis, we can prepare ourselves by diversifying our investments and the platforms we use.