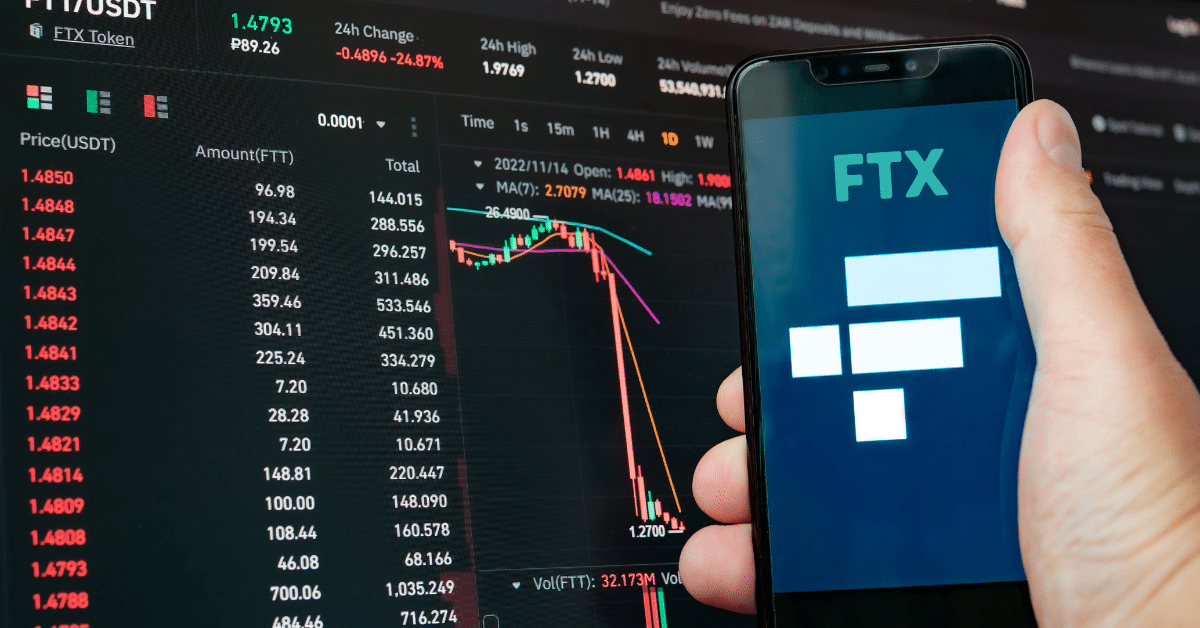

The FTX fall can affect the market in three ways. FTX is a crypto exchange that was once worth $32 billion. Market experts and investors are trying to measure the extent of damage it has caused to the crypto market and the effects it will have in the coming years.

The former boss of FTX, Sam Bankman Fried, stepped down on Nov 11 and was arrested last week in the Bahamas. Bankman Fried was charged with wire fraud, money laundering, and securities fraud by the U.S. government. The firm allegedly went above and beyond by using its sibling company Alameda Research to execute risky transactions by entering client accounts.

It can be assumed that the collapse and the drama that follows with the FTX collapse can cause significant industry changes.

Regulation

The crypto industry is not regulated under any circumstances, which means that investors are left with no one to turn to in the case of fraud or stealing funds. The protections that a licensed bank or broker provides are things that are not offered in the crypto industry.

This is very likely to change because the U.S. government, European Union, and the U.K. are doing their best to alter this notion of regulation and clean the market.

The current legislation to date is the EU’s Markets in Crypto-Assets. Holding exchanges responsible for investor fund losses seeks to lower the risks for customers purchasing cryptocurrency. However, MICA will not be implemented until 12 months from now.

Keystone Law’s Abbot says, “People need to see that there’s steps being taken to regulate it. And I think If we are able to offer some regulation, we will build confidence. If there’s no regulation, the investors are left without that protection that they need.”

Consolidation

In the years that followed the 2018 crypto winter, many new businesses and initiatives were launched, with FTX among them. In the years to come, fewer companies and coins will be introduced.

The fall of FTX has taken affect on the market in terms of contagion. A crypto lender, BlockFi, who previously requested financial assistance from FTX, has now entered bankruptcy. Now eyes are turned to Gemini and Genesis, who seem to also be in a rough state.

In a CNBC crypto conference in London, the CEO of Blockchain.com, Peter Smith, said the following. “The challenge for the whole space when you think about contagion is that FTX and Alameda were extremely active investors in this space.”

Near Foundation is a firm that took investment from FTX. The CEO, Marieke Flament, said that although the firm had only a little exposure to FTX, its collapse still came as a surprise. Marieke says, “I don’t think all the dominoes have fallen out from the contagion. The impacts that this will have is that a lot of projects actually are not going to have the funds, and therefore the resources, for them to continue to develop.”

Concerns have been raised about the biggest exchange in the world. In the previous week, Binance experienced outflows of billions of dollars. Right now, Binance is in a good state and not even close to bankruptcy. But with declining trading volumes and account balances, exchanges like Binance and Coinbase must deal with a bleak market environment.

Although their survival will depend on how seriously they handle risk management, governance, and regulation, experts believe they will continue to play a role.

Innovation

Although the crypto market has been through a lot, with the various falls.. the market can still pull through. In Flament’s words, “What we’re seeing a lot is companies having digital innovation arms or metaverse innovation arms. They understand that the technology is here. It’s not going to go away.”

Ian Rogers, the chief experience officer at Ledger, told CNBC, “Digital assets will be an increasing part of our lives, whether that is a collectible, a ticket, value, identity. Identity could be membership… people using NFTs they own to get access to a particular event or something like that.”

Robin – Coker, the CEO of mobile games firm Carry1st, compared Web3 today to the internet in the ’90s. He told CNBC, “It was clunky. You had dial-up, it took four minutes to get on, the original web browsers were not very intuitive. It’s really the early adopters that really engage at that stage. But over time, companies build smoother interfaces. And they cut steps out of it.”