- The Growing Market for EVs in Australia:

- BMW Expands EV Stocks in Australia:

- State Incentives Driving EV Adoption:

- State-by-State Breakdown of EV Sales:

- New South Wales

- Queensland

- Victoria

- Western Australia

- Australian Capital Territory

- South Australia, Tasmania, and Northern Territory

- The Rising Tide of EV Investments in Australia

- Top Australian EV Stocks in 2023:

- Tesla, Inc. (NASDAQ: TSLA)

- BYD (OTCMKTS: BYDDY) – A Rising Star

- MG, Polestar, and Volvo: Emerging Players

- Ionic Rare Earths (ASX: IXR)

- Chalice Mining (ASX: CHN)

- Oz Minerals (ASX: OZL)

- IGO (ASX: IGO)

- De Grey Mining (ASX: DEG)

- QMines (ASX: QML)

- Lake Resources (ASX: LKE)

- Core Lithium (ASX: CXO)

- Orocobre (ASX: ORE)

- Opportunities Across the Supply Chain

- Navigating Risks and Volatility

- The Future of EV Stocks in Australia

By 2023, BMW Group will have approximately twelve all-electric models ready for the road. This is made possible through intelligent vehicle architectures and a flexible production network. Thus, the BMW Group will offer at least one fully electric model in virtually all relevant series, from the compact segment to the ultra-luxury class. Following the BMW i3, the MINI Cooper SE and the BMW iX3, the BMW i4 and the BMW iX completed the all-electric range for customers in 2021.

Furthermore, the corporation has announced its plan to launch fully electric models for the BMW 5 Series, 7 Series, and BMW X1. Rolls-Royce and MINI are likewise resolutely charting a course to electromobility. In 2021, for instance, the fully electric MINI was the brand’s best-selling model. And BMW isn’t the only manufacturer expanding its EV car stocks in the Australian market.

Owning an electric car in Australia can be an intelligent way to maintain a luxurious lifestyle while reducing living expenses. With various incentives available, it’s worth considering as a cost-effective option.

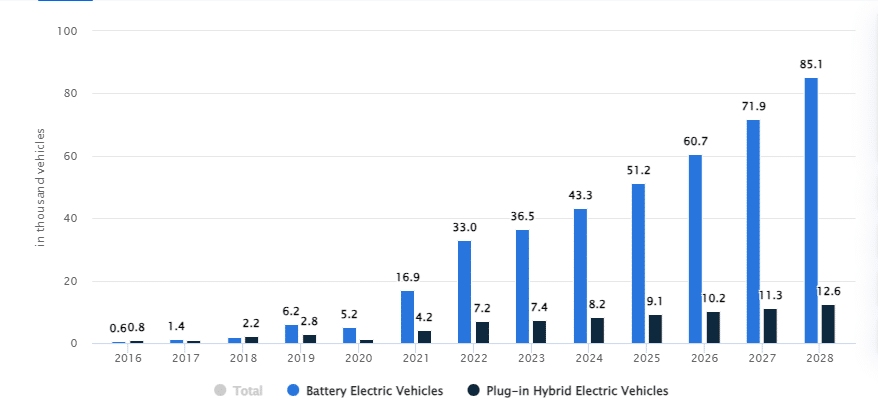

The Australian market for electric vehicles (EVs) is experiencing a significant surge in demand, with EV sales reaching new heights in the first quarter of 2023. As the country embraces the shift towards sustainable transportation, the market share of EVs has grown substantially, signifying a promising future for the industry. In this article, we will explore the top EV stocks in Australia, the growth of the EV market, and the state incentives driving this transition.

The Growing Market for EVs in Australia:

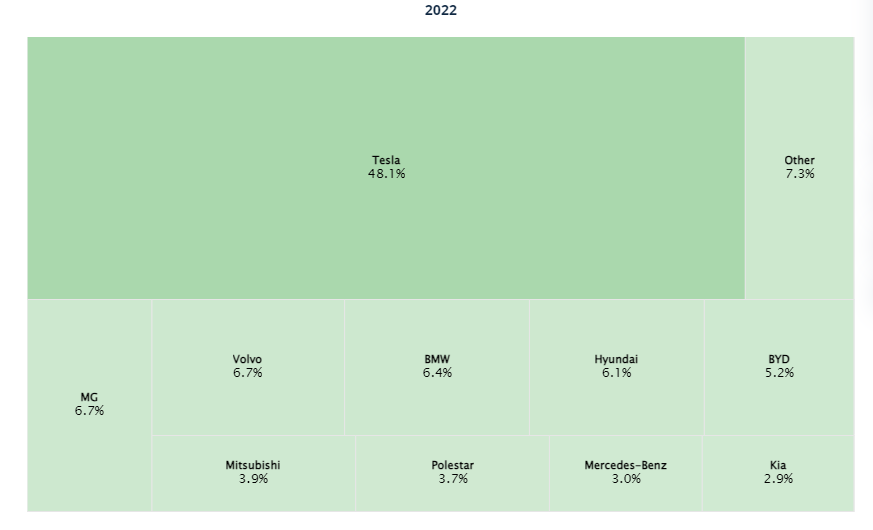

The Australian EV market has witnessed a remarkable growth rate, with EV sales soaring by 157.6% year-on-year in the first quarter of 2023. This surge in demand has propelled the overall EV market share to 6.5%, a significant increase from 2.6% in the previous year. In the Australian EV market, Chinese brands such as BYD, MG, Polestar, and Volvo have gained prominence alongside Tesla, which remains the leader in this space.

Source: Statista Market Insights

BMW Expands EV Stocks in Australia:

By 2023, BMW Group will have approximately twelve all-electric models that are ready for the road. This is made possible through intelligent vehicle architectures and a flexible production network. Thus, the BMW Group will offer at least one fully electric model in virtually all relevant series, from the compact segment to the ultra-luxury class. Following the BMW i3, the MINI Cooper SE and the BMW iX3, the BMW i4 and the BMW iX completed the all-electric range for customers in 2021.

Furthermore, the corporation has announced its plan to launch fully electric models for the BMW 5 Series, 7 Series, and BMW X1. Rolls-Royce and MINI are likewise resolutely charting a course to electromobility. In 2021, for instance, the fully electric MINI was the brand’s best-selling model.

State Incentives Driving EV Adoption:

To encourage the adoption of EVs, various states and territories in Australia have introduced purchase incentives in the form of rebates. For instance, residents of New South Wales can receive a $3000 rebate, while Queensland residents are eligible for up to a $6000 refund. These incentives have played a crucial role in incentivizing consumers to transition to electric vehicles and have contributed to the rapid growth of the EV market.

State-by-State Breakdown of EV Sales:

New South Wales

New South Wales leads the way in EV adoption, with 6,399 EVs sold in the first quarter of 2023, accounting for a 7.6% market share. The state’s substantial overall car in-use and attractive purchase incentives have contributed to its high EV market share.

Queensland

Queensland follows closely behind, with 3,892 EVs sold and a market share of 6.5%. The state’s generous rebate program has incentivized residents to switch to electric vehicles.

Victoria

Victoria recorded 3,621 EV sales in the first quarter, representing a 5.3% market share. The state’s commitment to sustainability and infrastructure development has driven EV adoption.

Western Australia

Western Australia saw 1,524 EV sales, accounting for a 5.5% market share. The state’s ongoing efforts to expand EV charging infrastructure have encouraged consumers to embrace electric vehicles.

Australian Capital Territory

The Australian Capital Territory boasts the highest EV market penetration, with EVs capturing an impressive 18.9% market share. The territory’s commitment to sustainability and stringent emission standards have propelled EV adoption to new heights.

South Australia, Tasmania, and Northern Territory

EV adoption has steadily grown in South Australia, Tasmania, and the Northern Territory, with market shares ranging from 2.0% to 6.5%. These regions are actively implementing initiatives to promote and support the transition to electric vehicles.

The Rising Tide of EV Investments in Australia

Australia is experiencing a significant shift in the automotive industry, with the government setting ambitious goals to promote the adoption of EVs. In line with global trends, Australia has set its sights on decreasing greenhouse gas emissions and shifting towards a transportation system that is cleaner and more sustainable. As a result, investors are increasingly turning their attention to Australian EV stocks.

Top Australian EV Stocks in 2023:

For investors who want to tap into the expanding market of electric vehicles, investing in EV stocks can be a profitable opportunity. Australian investors have various options, from established companies to emerging players in the EV sector. However, It is essential to approach these investments cautiously and conduct thorough research to mitigate risks associated with the industry’s volatility.

In this section, we will dive into the top EV stocks in Australia, providing essential information about each company, including their stock ticker symbol, stock price, market capitalization, and performance year-to-date. Investors looking to take advantage of the growing EV market in Australia may find these stocks to be the most promising opportunities.

Tesla, Inc. (NASDAQ: TSLA)

Tesla, Inc. remains a dominant player in the EV market globally and in Australia. With a market capitalization of US$578 billion, Tesla is the leading EV stock traded by Australian investors. The company’s stock price has grown significantly, with a year-to-date increase of 70.68%. Tesla’s success can be attributed to its innovative electric vehicles and commitment to sustainable transportation.

BYD (OTCMKTS: BYDDY) – A Rising Star

BYD, a Chinese electric car manufacturer, has rapidly gained traction in the Australian market, positioning itself as a strong contender to Tesla. The company’s Atto 3 model has garnered significant attention, securing the third spot on the model charts for EV sales. With Warren Buffett’s Berkshire Hathaway owning about 6% of BYD and its commitment to delivering high-quality electric vehicles, BYD is poised to challenge Tesla’s dominance in the coming years.

MG, Polestar, and Volvo: Emerging Players

MG, a British automotive brand now owned by Chinese company SAIC Motor (SHA: 600104), has made significant strides in the Australian EV market. With its affordable yet stylish electric vehicles, MG has captured consumers’ attention looking for an accessible entry point into the EV market. Polestar, a subsidiary of Volvo, focuses exclusively on producing electric performance vehicles, catering to customers seeking a premium driving experience. Volvo, a renowned luxury car manufacturer, has also made a strong foray into the EV market, positioning itself as a reliable and sustainable choice for eco-conscious consumers.

Electric vehicles (EVs) are becoming increasingly popular worldwide, and Australia is no exception. The demand for EVs is on the rise in the country. As the world transitions towards sustainable transportation, the Australian market is witnessing a surge in interest in EV stocks. Our guide delves into the best Australian EV companies of 2023, offering valuable insights for investors who want to take advantage of this expanding trend.

Ionic Rare Earths (ASX: IXR)

Ionic Rare Earths is an Australian company operating in Uganda, focusing on the high-value end of the rare earth market. With its unique position in the industry, Ionic Rare Earths presents an exciting investment prospect. Although it operates offshore, Australian investors can easily access this company through the ASX.

Chalice Mining (ASX: CHN)

Chalice Mining has gained attention in the Australian ev stocks market due to its significant uplift following a successful drilling program for copper and nickel. With promising exploration areas, Chalice Mining has the potential to become an essential player in the EV metals sector. Investors need to be mindful of the difficulties of extracting minerals from a “poly-metallic” deposit, such as the one owned by Chalice Mining.

Oz Minerals (ASX: OZL)

Oz Minerals is a mid-tier mining company in Australia that offers exposure to the EV metals sector. Unlike giants like Fortescue and BHP, which primarily focus on iron ore, Oz Minerals has a diversified portfolio, generating strong cash flow from non-producing assets while actively exploring new deposits. Oz Minerals’ well-balanced position makes it an appealing investment choice for EV market investors.

IGO (ASX: IGO)

Similar to Oz Minerals, IGO is a mid-tier mining company in Australia that offers exposure to the EV metals sector. With a focus on exploration and production, IGO has the potential to discover new deposits while maintaining a solid balance sheet. Investors seeking mid-tier opportunities in the EV market should consider IGO as a potential investment option.

De Grey Mining (ASX: DEG)

De Grey Mining has made significant discoveries in the gold sector, particularly in Western Australia. With a successful exploration program, De Grey Mining has attracted the attention of investors looking for gold exposure. The company’s presence in historically productive areas with high-grade deposits positions it as an exciting investment opportunity.

QMines (ASX: QML)

QMines is an Australian company exploring brownfield prospects in Queensland. While still in the early stages, QMines operates in historically productive areas with promising grades. If successful, QMines could experience substantial growth and become an essential player in the Australian EV metals sector.

Lake Resources (ASX: LKE)

Lake Resources is an Australian company utilizing ion exchange resins to extract lithium from brine without using traditional evaporation methods. This innovative approach could significantly impact the lithium market, allowing lithium extraction from lower-grade brines or seawater. Lake Resources’ unique technology positions it as a potential disruptor in the EV metals sector.

Core Lithium (ASX: CXO)

Core Lithium is an Australian company with a promising lithium project, the Finniss mine. With proximity to existing infrastructure and a low construction and commission risk, Core Lithium is well-positioned to become a significant player in the spodumene market. Investors seeking exposure to the Australian lithium stocks sector should closely monitor Core Lithium’s progress.

Orocobre (ASX: ORE)

Orocobre is an established player in the lithium market, operating in Argentina. Orcorbre is one of the best Australian lithium shares. With its recent merger with Galaxy, Orocobre is set to become a major lithium producer, with a projected production capacity comparable to global lithium miner SQM. Despite its growth potential, Orocobre’s valuation remains relatively low compared to its global peers, presenting an attractive investment opportunity.

Opportunities Across the Supply Chain

In addition to the Australian EV stocks mentioned above, there are opportunities across the EV supply chain in Australia. Individuals interested in investing in electric vehicle metals have diverse investment opportunities at their disposal. Various options are available from companies exploring, developing, and producing these metals. It is crucial to consider the dynamics of the supply chain and the potential for growth in each sector when making investment decisions.

Navigating Risks and Volatility

Investing in EV stocks comes with inherent risks and volatility. As with any investment, it is essential to conduct thorough research, analyze market trends, and understand the specific risks associated with each company. Factors such as competition, regulatory changes, and market fluctuations can significantly impact the performance of EV stocks. Investors must consider their level of risk tolerance and ensure that they have diversity in their portfolios to minimize potential losses.

The Future of EV Stocks in Australia

As the Australian market for electric vehicles continues to expand, the future looks promising for Australian EV stocks. With the ongoing commitment of governments and consumers to sustainable transportation, the demand for Australian EV stocks is expected to soar. Investors keen on capitalizing on this trend should closely monitor the performance of top Australian EV stocks like Tesla, BYD, MG, Polestar, and Volvo. By aligning their investment portfolios with the growing EV market, investors can potentially reap significant rewards while contributing to a greener and more sustainable future.

Source: Statista Market Insights

Conclusion – Electric Vehicle Stocks in Australia

The Australian market for electric vehicles is undergoing a transformative shift, with EV sales experiencing exponential growth. With Tesla leading the pack and strong contenders like BYD, MG, Polestar, and Volvo emerging, the future of EV stocks in Australia looks promising. State incentives and infrastructure developments have played a crucial role in accelerating EV adoption.

As more consumers embrace electric vehicles, the demand for EV stocks is expected to rise. Investors can seize this opportunity by diversifying their portfolios and capitalizing on the growing EV market. With the transition to sustainable transportation gaining momentum, the Australian EV market is poised for a bright future.