Achieving 2023 Market Profits can be very hard and tense . The world of trading is constantly evolving, and new crypto trading indicators are being introduced regularly. While some indicators have become popular, others remain relatively unknown or underutilized. In the world of crypto and Forex trading, it can be easy to get caught up in using the same few indicators commonly discussed, such as Moving Averages or Relative Strength Index (RSI). However, there is a wealth of alternative, low-volume hands that offer unique insights and have the potential to give traders a competitive edge and to make 2023 market profits.

Here, we’ll explore some lesser-known, emerging crypto trading indicators that are making a name for themselves in the world of crypto and Forex trading in 2023. These indicators are not only innovative and cutting-edge, but they also offer traders a new perspective on market trends and conditions and helps them achieve .

In this article, we will explore some of the emerging indicators that can help traders maximize their 2023 market profits:

Crypto Trading Indicators:

These indicators are designed for use in the highly dynamic and volatile crypto market. Take into account the unique characteristics of cryptocurrencies, such as 24/7 trading, large price swings, and a high degree of market uncertainty. Some emerging crypto trading indicators include the Ichimoku Cloud, Fibonacci retracements, and the Bollinger Bands.

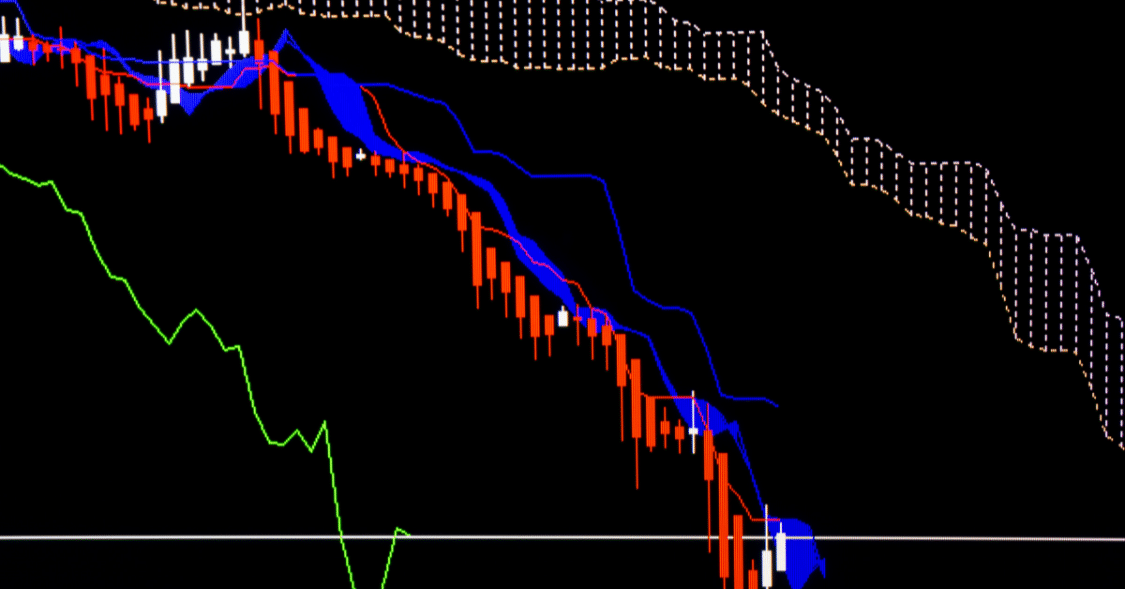

- The Ichimoku Cloud is a technical indicator that was developed in Japan in the late 1930s. It provides a comprehensive view of market trends and conditions, including support and resistance levels, momentum, and potential price reversal areas. The Ichimoku Cloud can be beneficial for crypto traders, as it takes into account the extraordinary volatility of the market and can help traders identify key entry and exit points.

- Fibonacci retracements are another popular indicator used in crypto trading. This indicator is based on the idea that prices can retrace a predictable portion of a move, after which they will continue to move in the original direction. Fibonacci retracements can be particularly useful in identifying potential support and resistance areas and can help traders make informed decisions about entry and exit points.

- Bollinger Bands are a volatility indicator consisting of a moving average and two deviation lines. They are used to measure the volatility of an asset and can help traders determine whether prices are relatively high or low. The Bollinger Bands can be particularly useful in crypto trading, as they can help traders identify market trends and potential price reversals.

Forex Market Indicators:

The Forex market is one of the world’s largest and most liquid markets, making it a popular choice for traders. Emerging Forex market indicators provide a fresh perspective on currency trends and can help traders make informed decisions. Some new Forex market indicators include the Average True Range (ATR), the Parabolic SAR, and the Moving Average Convergence Divergence (MACD).

- The Average True Range (ATR) is a volatility indicator that measures the average range of price movement over a given period. The ATR can be particularly useful in the Forex market, as it can help traders determine the volatility of a currency pair and make informed decisions about entry and exit points.

- The Parabolic SAR is a trend-following indicator used to identify potential price reversals. The indicator is based on the idea that prices tend to follow a parabolic path, and the Parabolic SAR can help traders identify key entry and exit points. This is particularly relevant for forex market indicators as it can help traders identify market trends, and potential price reversals and get traders one step closer to 2023 market profits.

- The Moving Average Convergence Divergence (MACD) is a momentum indicator used to determine a market trend’s strength and direction. The MACD is calculated by subtracting the 26-day exponential Moving average from the 12-day exponential Moving average. The MACD also includes a histogram that plots the difference between the MACD line and a 9-day exponential Moving average, known as the signal line. This histogram provides insight into the market’s momentum and can help traders determine the strength and direction of a trend. The MACD can be particularly useful in the Forex market, as it can help traders identify potential trend changes and make informed decisions about entry and exit points.

- Another emerging Forex market indicator is the Average Directional Index (ADX). The ADX is a trend strength indicator that measures the power of a trend and can be used to determine whether a market is trending or non-trending. The ADX is calculated using a combination of positive and negative directional movement indicators and can help traders identify the strength of a trend and make informed decisions about entry and exit points.

In conclusion, many new and emerging indicators in the world of crypto and Forex trading offer traders a fresh perspective and the potential to give them a competitive edge. Whether you are an experienced trader or just starting, exploring these alternative forex market indicators can provide new insights and help you make informed decisions about your trades. However, it is essential to remember that no single indicator can guarantee success. It is always best to use a combination of indicators to view market trends and conditions comprehensively.