The Australian economy has been facing several challenges recently, with the Reserve Bank of Australia (RBA) closely monitoring key indicators to forecast its future path. When analysing the Australian economy forecast, it’s essential to consider the factors that impact its direction, such as interest rates, inflation, and industry-specific trends. We can gain valuable insights into potential opportunities and risks by examining these factors.

The Current State of the Australian Economy

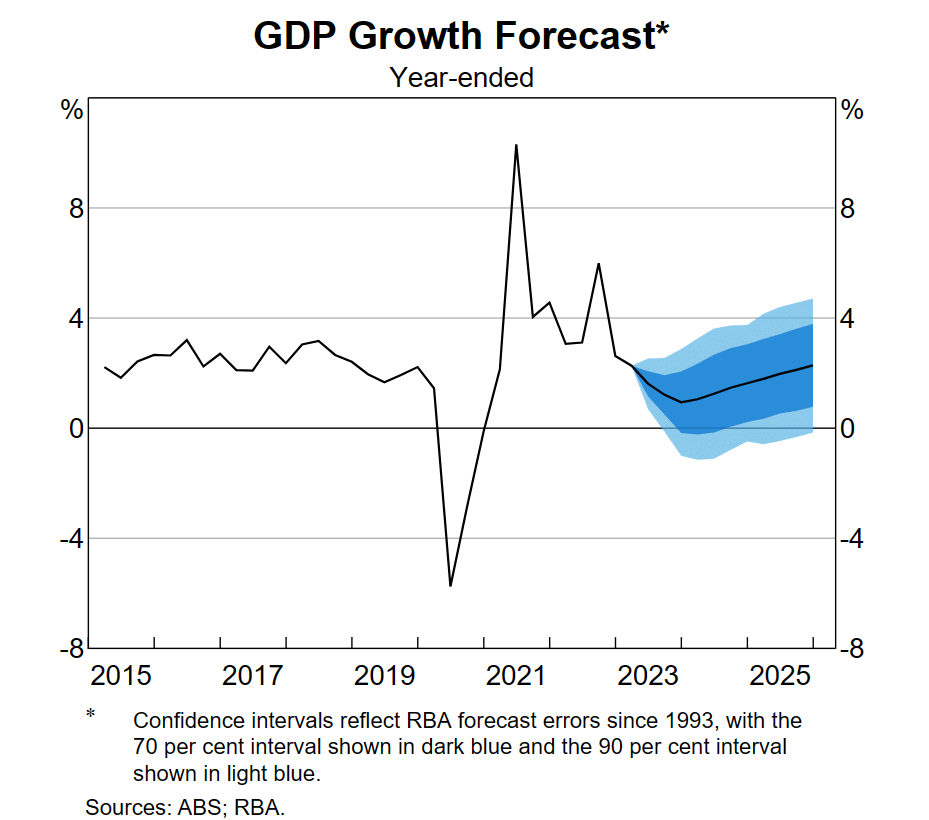

The global economic landscape has played a significant role in shaping the Australian economy. While the world has witnessed surprising resilience, the Australian economy has faced headwinds. The RBA has implemented a series of interest rate increases, which have dampened economic activity. As a result, the growth forecast for the Australian economy has been revised downwards.

According to Deloitte Access Economics, Australia’s economic growth is expected to be just 0.9% in the 2023-24 financial year, a significant drop from the average annual growth rates witnessed in the past. This downward trend is primarily driven by tightening monetary policy and cost-of-living pressures. The RBA’s interest rate increase has significantly impacted domestic demand and consumer spending.

The Impact of Interest Rates on the Australian Economy

The RBA has raised interest rates more than anticipated, profoundly affecting businesses and consumers significantly shaping the Australian economy. This tightening of monetary policy has reduced businesses’ access to debt and equity funding, forcing them to prioritise cost reduction. The construction industry, in particular, has felt the brunt of these changes, with rising costs and supply chain disruptions leading to numerous collapses.

While the RBA’s decision aims to control inflation, there are concerns that it may have tightened monetary policy too aggressively. Deloitte Access Economics argues that most of the inflationary pressures in the system stem from supply-side issues, making them immune primarily to monetary policy. As a result, further interest rate increases may not effectively address the root causes of inflation and could hinder economic recovery.

Understanding Inflation Drivers in Australia

The Australian economy forecast is greatly affected by inflation, which influences consumer spending, the cost of living, and monetary policy decisions. Unfortunately, Australia has recently been facing high inflation rates, which are mainly caused by supply-side factors. The high costs of energy, supply chain disruptions, and housing market limitations all contribute to the ongoing pressures of inflation.

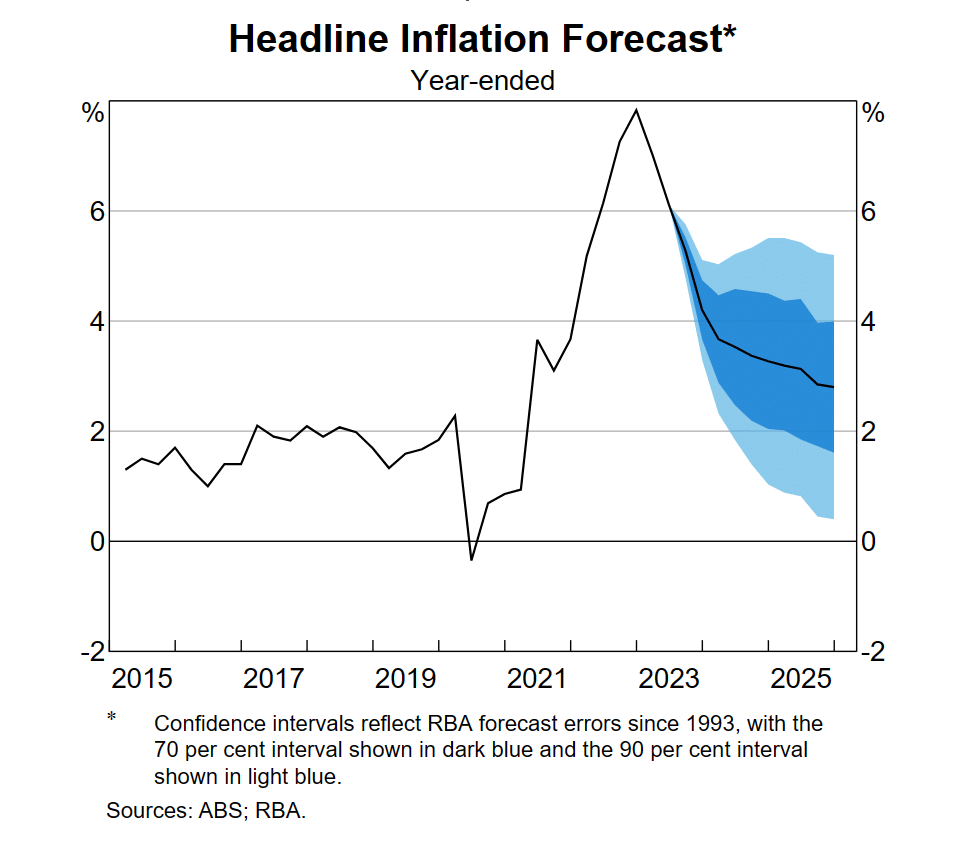

The resolution of supply disruptions is expected to drive a decline in inflation over the next few years. As global supply chain pressures ease and economic activity normalises, imported goods’ prices are expected to moderate. However, it is essential to note that the normalisation of core inflation may be slower, with deceleration in some areas offset by acceleration in others.

Services inflation, driven by rising labour costs and high demand, is expected to remain high in the near term before gradually easing as demand moderates. Rent inflation is also projected to increase further due to low rental vacancy rates and the lagging response of housing supply to population growth.

Industries Impacted by Inflation in Australia

Construction

The Australian economy forecast has varying impacts on different industries, with the construction industry being hit particularly hard due to rising costs and supply chain delays. Interest rates are increasing, workforce retention is challenging, and pandemic-related stimulus programs are ending, which the University of NSW (UNSW) has referred to as a “perfect storm.”

Lockdowns due to COVID-19 and significant financial assistance to non-working individuals have caused supply shortages both in Australia and abroad, leading to the collapse of several major companies, including Porter Davis, Probuild, ABG, and A1A Homes.

The Reserve Bank of Australia (RBA) has implemented loose fiscal policies and printed significant amounts of money, leading to inflation. It has also caused a rise in the cash rate, which has gone from nearly zero to over 4% per year, putting additional financial strain on builders. This has exacerbated the already declining housing prices and decreased the number of properties for sale. The retail sector has also been affected by tightening monetary policy and reduced consumer spending, resulting in some businesses defaulting.

Mining

In-Text Citation: (Jericho et al., 2023)

On the other hand, the mining industry in Australia has seen a remarkable increase in profits over the past two years due to the elevated prices of fossil fuels like coal, gas, and petroleum, as well as other minerals. These profits are enormous, with data from the ABS showing that mining corporations’ gross operating profits hit $295 billion in 2022, equivalent to 12% of the country’s GDP.

Over the past three years, corporate gross operating profits in mining have grown by 89% from the end of 2019 to the end of 2022. Mining profits now account for 51.5% of all corporate operating profits in the entire economy, surpassing half of the profits for the year. Those who suggest that mining profits should be excluded from macroeconomic considerations, including inflation, propose excluding most profits in Australia.

Retail

The effects of the Australian economy forecast go beyond these industries. Cafes, restaurants, and other retailers are experiencing a decline in consumer spending, leading to financial challenges. The retail recession in Australia is mainly caused by the reduction in consumer buying power. According to the national accounts figures for the March quarter, households in Australia mainly spent their money on essential items such as energy, while also dipping into their savings. This implies that people are prioritizing necessary expenses and reducing their spending on non-essential items.

The largest bank in Australia, Commonwealth Bank of Australia, has predicted a contraction in the economy per capita for the March quarter, with further decline expected. Additionally, CBA has estimated a 50% chance of a recession in Australia this year due to the ongoing impact of monetary tightening, which is putting pressure on households.

Additionally, initiatives such as healthcare are expected to face difficulties as government funding fails to keep up with increasing costs.

The Role of Inflation and Interest Rates in the Risk of a Recession

The interconnectedness of inflation, interest rates, and the risk of a recession is a critical aspect of the Australian economy forecast. Inflation remains a concern, with the Consumer Price Index continuing to rise. While half of the businesses surveyed believe inflation will stay static, one-third expect it to increase further, increasing the risk of inflation becoming entrenched in daily life.

The RBA’s decision to increase interest rates aims to manage inflation. However, the cumulative effect of these rate hikes, combined with reduced consumer spending, can potentially push the Australian economy into a recession. Insolvency professionals predict Australia could face a recession in the next two years, with some believing it could occur within the next 12 months.

The reduced spending resulting from higher interest rates further impacts business insolvencies, creating a waterfall effect throughout the economy. Construction companies were the first to experience financial difficulties due to fixed-price contracts and rising costs. As the impact ripples through other sectors, such as retail and services, the risk of a recession becomes more pronounced.

The Path Forward: Navigating the Australian Economy Forecast

While the Australian economy faces challenges in the coming years, it is essential to approach the future with a sense of realism and preparedness. The normalisation of the economy after the artificial stimulus caused by COVID-19 will undoubtedly come with some pain. However, it is crucial to recognize that this is part of returning to a real-world setting.

In order to navigate the Australian economy forecast effectively, businesses need to focus on cost reduction and identify areas of potential growth, which may include diversifying revenue streams, exploring new markets, and adopting innovative strategies to improve productivity. Additionally, policy interventions should be considered to address market power issues, improve efficiency, and boost competition.

It is equally important for individuals to be aware of the potential risks and opportunities presented by the Australian economy forecast. By staying informed about economic trends, interest rates, and inflation, individuals can make informed decisions about their finances, investments, and overall financial well-being.

In conclusion, the Australian economy forecast presents both challenges and opportunities. The impact of interest rates, inflation, and industry-specific trends will shape the economy’s trajectory in the coming years. By understanding these factors and taking proactive measures, businesses and individuals can navigate the evolving economic landscape and make informed decisions for a sustainable future.