It appears that the real estate market in China is currently facing a serious crisis, which could potentially have a major impact on the broader economy. Considering China’s position as the world’s second-largest economy, any instability in the real estate sector has the potential to cause ripples across global markets. Together we’ll delve into the reasons behind China real estate crisis and its potential consequences, as well as analyse the impact it has on other stocks traded on the Chinese stock exchanges.

Understanding the China Real Estate Crisis

The crisis in China’s real estate industry has several causes, including excessive borrowing, overbuilding, and a slump in housing. This sector has been crucial to China’s economic growth for many years, providing employment to millions and acting as a repository for household savings. The real estate industry in China is believed to contribute up to a quarter of the country’s economic activity, both directly and indirectly.

However, years of excessive debt accumulation and rapid construction have led to market saturation, causing housing prices to decline and leaving many properties unfinished or empty.

The crisis intensified in mid-2021, with an increasing number of private property developers defaulting on their debts.

According to S&P, companies accounting for 40% of Chinese home sales have defaulted, leaving behind unfinished homes, unpaid suppliers, and disgruntled investors. The defaults have affected financial institutions and ordinary individuals who invested in wealth management products linked to trust financing.

The Ripple Effect on the Stock Market

The real estate market crisis in China has significantly affected the country’s stock market, causing ramifications for both investors and businesses. As a result of the crisis, confidence in the real estate sector has decreased, causing a significant drop in the stock prices of real estate companies. Many offshore bonds are now being traded at much lower valuations, and both equity and debt markets are experiencing a lack of liquidity as investors and creditors avoid the troubled sector.

The crisis has implications that go beyond the real estate market, as weak home sales can potentially delay the recovery of the broader Chinese economy. The real estate sector is a crucial player in the Chinese economy, accounting for more than 25% of economic activity. Any decline in consumer spending or housing prices can have far-reaching consequences on the overall economy.

The Risks and Challenges Ahead

The challenges posed by the China real estate crisis are multi-faceted and require careful consideration from policymakers and market participants. The sheer number of unfinished homes poses a problem for developers like Country Garden, China’s largest developer by sales volume.

According to its preliminary report, the company predicts a net loss of between 45 billion yuan ($6.24 billion) and 55 billion yuan for the first half ended on June 30, which is a significant decrease from the net profit of 1.91 billion yuan reported in the same period the previous year. With nearly one million homes to complete, developers face immense financial pressure and the risk of insolvency.

The debt crisis also raises concerns about the stability of China’s shadow banking sector. Trust companies, which offer investments with higher returns than traditional bank deposits, have significant exposure to the real estate sector. The missed payments on investment products by leading trust firm Zhongrong International Trust Co highlight the vulnerability of China’s $3 trillion shadow banking industry.

The Role of the Central Government

Investors and market observers have closely watched the central government’s response to the China real estate crisis. While some speculated that Beijing would intervene with substantial stimulus measures, the government has so far opted for more modest gestures, such as relaxing mortgage requirements and cutting interest rates. There is a growing sense of anticipation as to whether more significant measures will be implemented to stem the downward spiral.

However, the government faces a delicate balancing act. While supporting the housing market is crucial, policymakers must also ensure that debt levels are kept in check. Excessive stimulus measures could exacerbate China’s debt problem and undermine long-term economic stability. As such, any intervention by the central government must be carefully calibrated to address the crisis without creating new risks.

The Outlook for Investors

The crisis in China’s real estate market has brought about a lot of uncertainty in the investment world. It’s understandable that investors are worried about how this might affect their portfolios and other sectors. It’s important that investors take caution and thoroughly research before making any investment decisions.

Top 10 Potential Growth Stocks in the Chinese Stock Market

While the crisis has created challenges, it has also presented opportunities in other sectors of the Chinese stock market. As real estate stocks falter, investors may diversify their portfolios by exploring industries less affected by the crisis. Sectors such as technology, healthcare, and renewable energy have shown resilience and growth potential, making them attractive options for investors seeking alternative investment avenues.

We have analysed the performance of our top Chinese stocks in comparison to Country Garden’s stock and the China Real Estate Index of NASDAQ’s NQCN 35. This analysis was done to evaluate the recent performance of these companies. Based on our analysis, here is our 10 top stocks to consider during the current crisis in China’s real estate market:

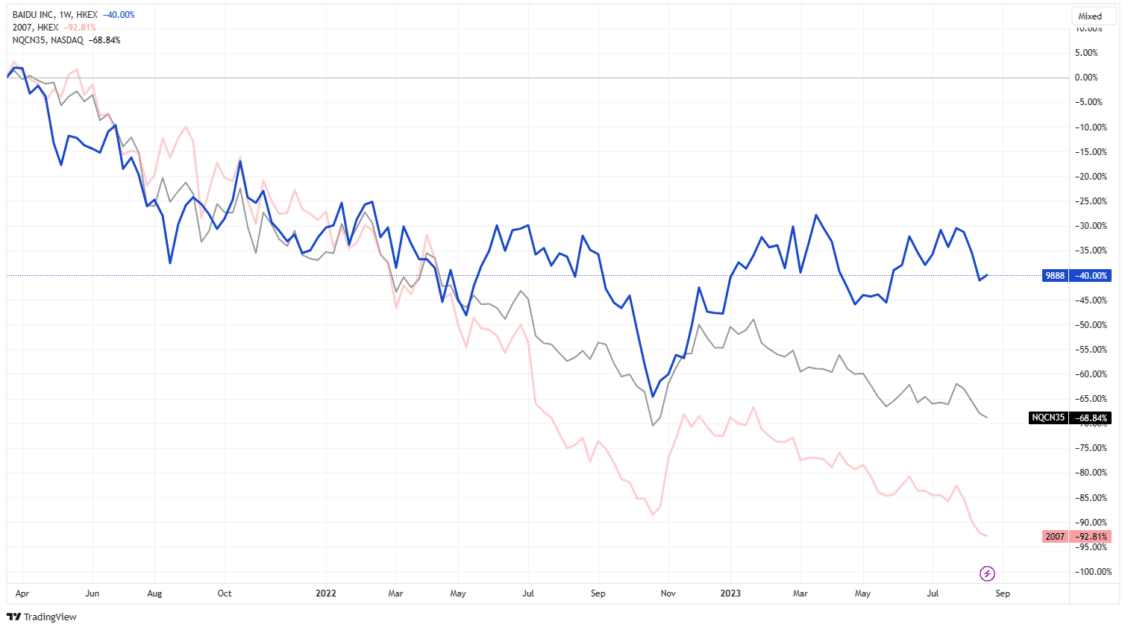

Baidu (HKG: 9888)

Grey – China Real Estate Index (NASDAQ: NQCN35)

Source: TradingView

Baidu is a multinational technology company from China that focuses on internet-based products, services, and artificial intelligence. It is a leading global company in the AI and internet sectors and has the second-largest search engine worldwide. Baidu has a 76.05% market share in China’s search engine market. In December 2007, Baidu made history as the first Chinese company to be added to the NASDAQ-100 index. As of August 2023, Baidu’s market capitalization is $43.98 billion.

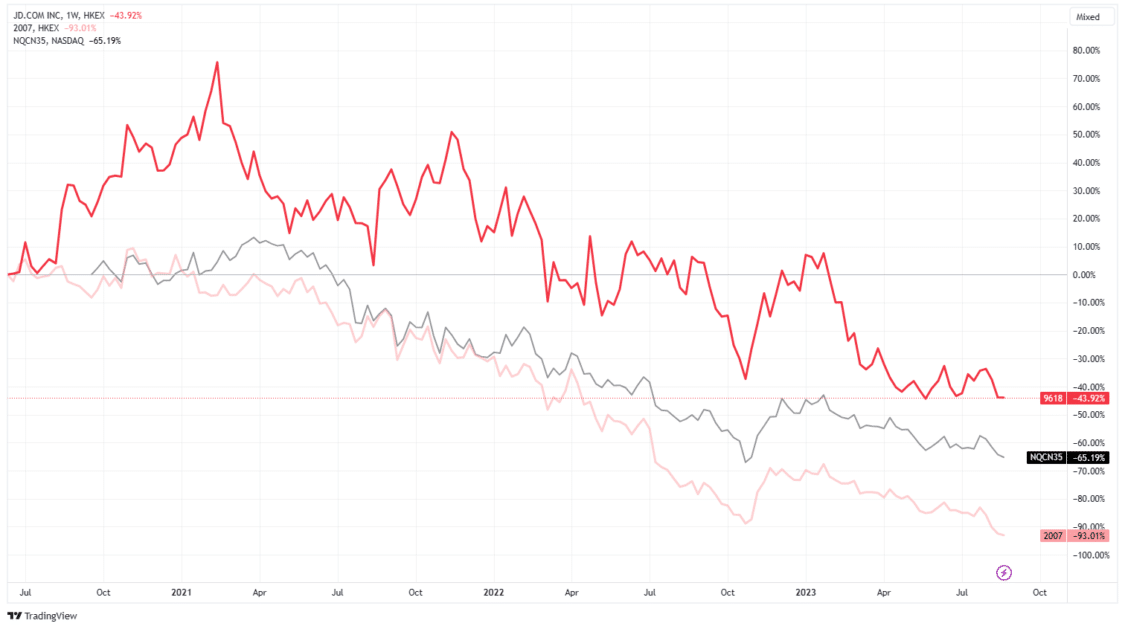

JD (HKG: 9618)

Grey – China Real Estate Index (NASDAQ: NQCN35)

Source: TradingView

Jingdong, commonly known as JD.com, is a Chinese e-commerce enterprise in Beijing. It’s the most extensive online retailer in China and the most significant internet corporation in the country regarding revenue. JD.com is known for its dedication to quality, authenticity, and vast product selection, ranging from fresh groceries and clothing to electronics and cosmetics. Its unparalleled fulfilment network covers 99% of China’s population, providing standard same-day and next-day delivery. In 2022, JD.com achieved a net revenue of US$151.7 billion.

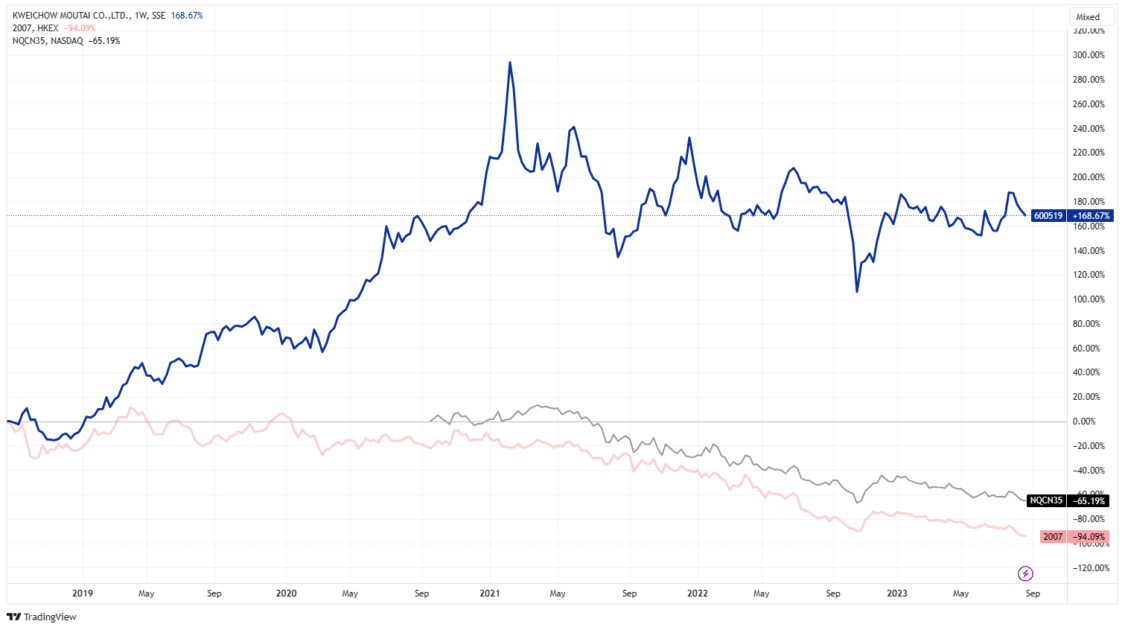

Kweichow Moutai (SHA: 600519)

Grey – China Real Estate Index (NASDAQ: NQCN35)

Source: TradingView

Kweichow Moutai Co., Ltd. is a Chinese company that specializes in producing and selling Maotai Baijiu, a type of spirit. They also produce and sell beverages, food, and packaging material. In addition, they develop anti-counterfeiting technology and research and develop relevant information technology products. The company is partially state-owned and partially listed on the Shanghai Stock Exchange. In 2021, Kweichow Moutai holds the title of being the largest beverage company in the world and China’s most valuable non-technology company. Furthermore, it surpassed Tencent in 2022 as China’s largest company by market capitalization.

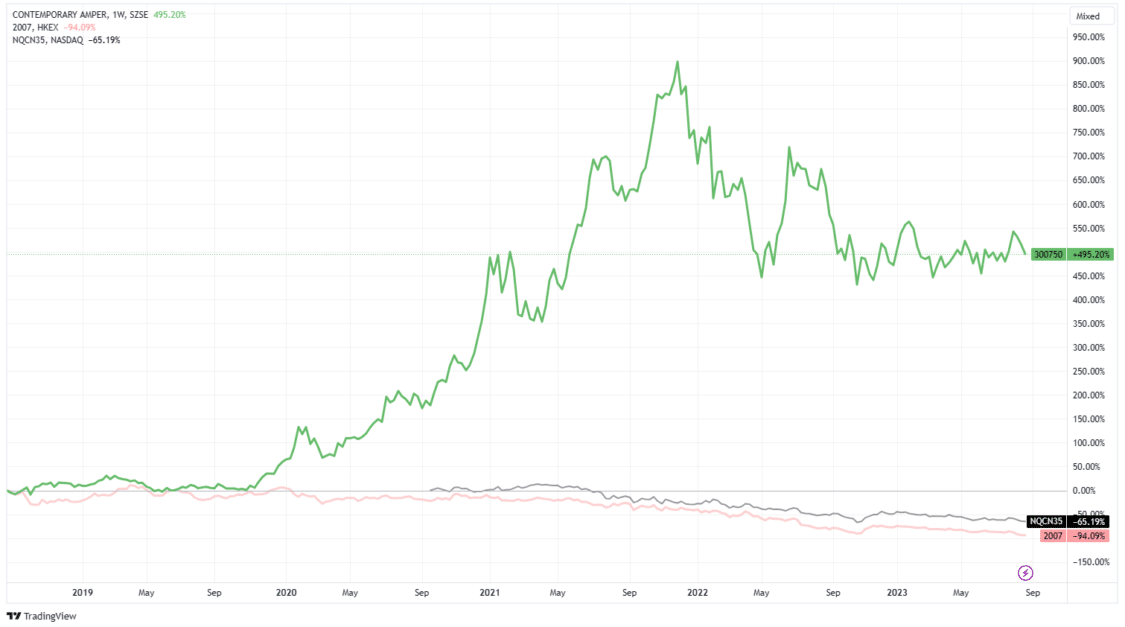

Contemporary Amperex Technology Co., Limited (SHA: 300750)

Grey – China Real Estate Index (NASDAQ: NQCN35)

Source: TradingView

CATL was founded in 2011. They focus on creating lithium-ion batteries for electric vehicles, energy storage systems, and battery management systems. CATL is currently the biggest lithium-ion battery manufacturer for EVs worldwide, with a market share of 32.6% in 2021. They produced 96.7 GWh of the total 296.8 GWh, which is a 167.5% increase from the previous year. In 2022, the company increased its market share to 37%. CATL aims to increase its manufacturing capacity to over 500 GWh by 2025 and 800 GWh by 2030. Here are more EV stocks you must check out in 2023.

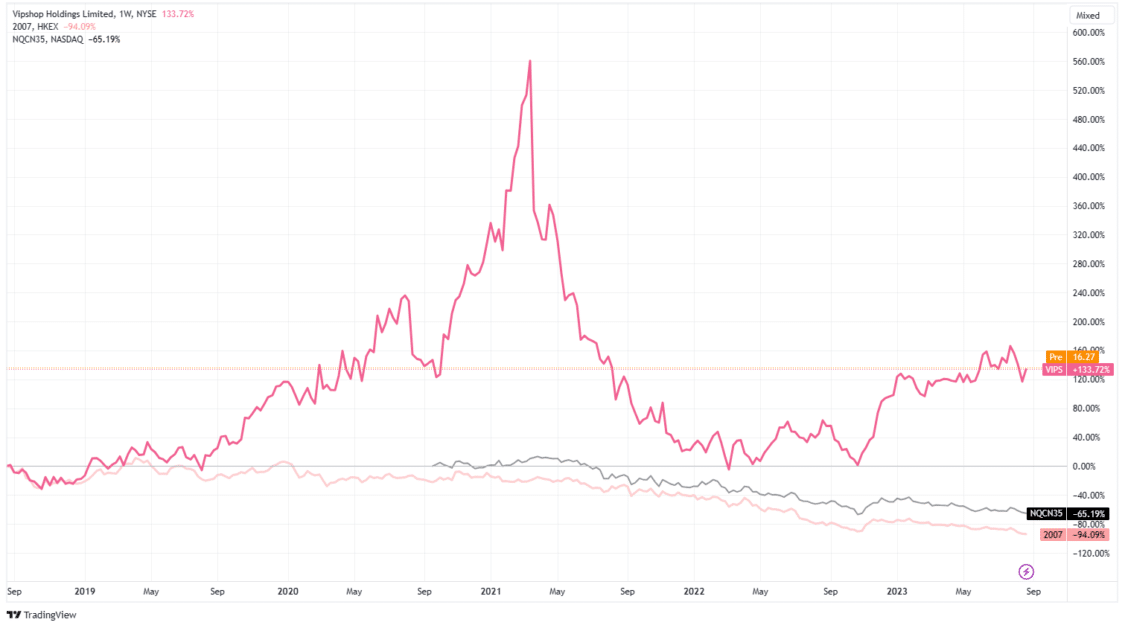

Vipshop (NYSE: VIPS)

Grey – China Real Estate Index (NASDAQ: NQCN35)

Source: TradingView

Vipshop is a Chinese company that operates the e-commerce website VIP.com, specializing in online discount sales. The company is based in Guangzhou, Guangdong, China and was listed on the New York Stock Exchange (NYSE) on March 23, 20121. Vipshop is now China’s third largest e-commerce site, following Tmall and JD.com. According to Fortune magazine, VIP.com ranked 115th in its 2017 “China 500” listing and was listed as the top 3 B2C e-commerce retailer. In 2017, Vipshop had 52.1 million customers, and there were 269.8 million orders for 2016.

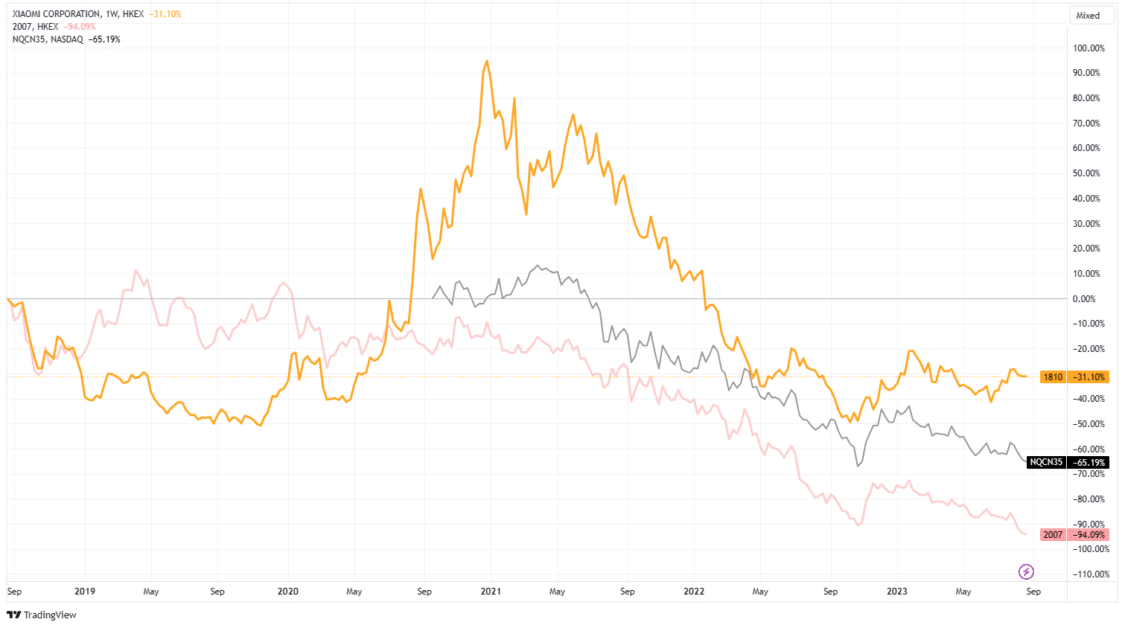

Xiaomi (HKG: 1810)

Grey – China Real Estate Index (NASDAQ: NQCN35)

Source: TradingView

Xiaomi is a multinational electronics company based in Beijing, China. It was founded in April 2010 and produces various products, including smartphones, mobile apps, laptops, home appliances, consumer electronics, bags, shoes, and more. In addition, Xiaomi is one of the four companies globally, alongside Apple, Samsung, and Huawei, that has the capability to develop its own mobile system-on-chip (SoC).

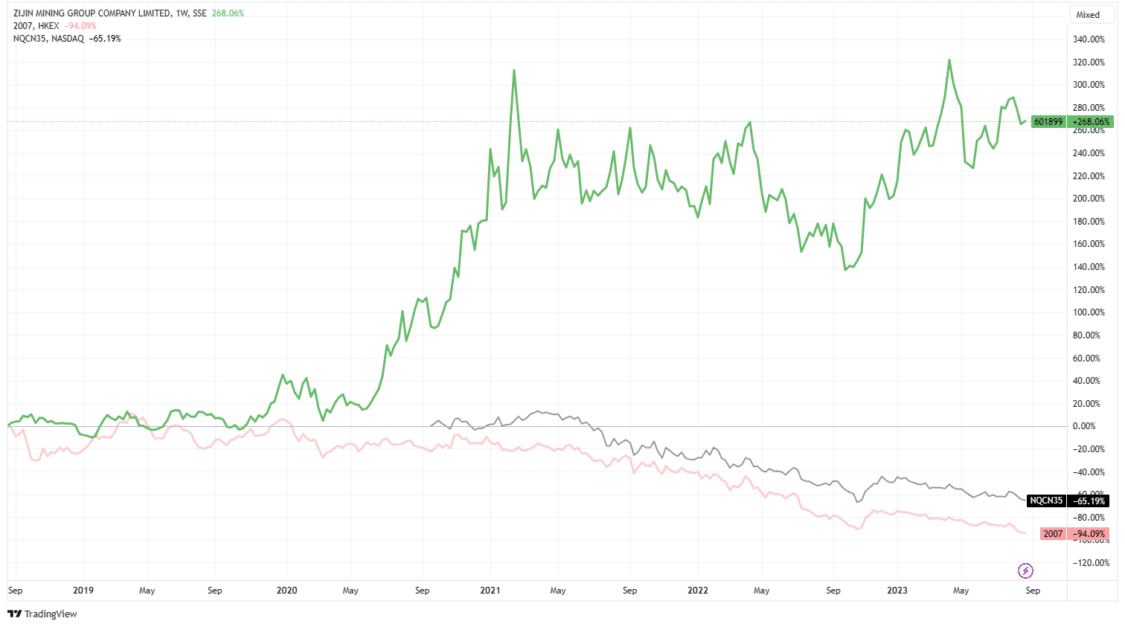

Zijin Mining Group Co., Limited (SHA: 601899)

Grey – China Real Estate Index (NASDAQ: NQCN35)

Source: TradingView

During times of market decline, investors often turn to commodities such as gold as a viable investment option. Zijin Mining Group Co., Limited is a leading mining company that operates on a global scale. They specialize in exploring and developing various minerals such as copper, gold, zinc, and lithium, as well as engineering and technological research. Zijin Mining operates in 11 different countries and is considered one of the largest producers of gold, copper, and zinc in China. The company’s largest shareholder is Shanghang Minxi Xinghang State-Owned Property Investment Company, which owns 24% of Zijin and is owned by the government of Shanghang County, Fujian Province, where Zijin’s head office is located.

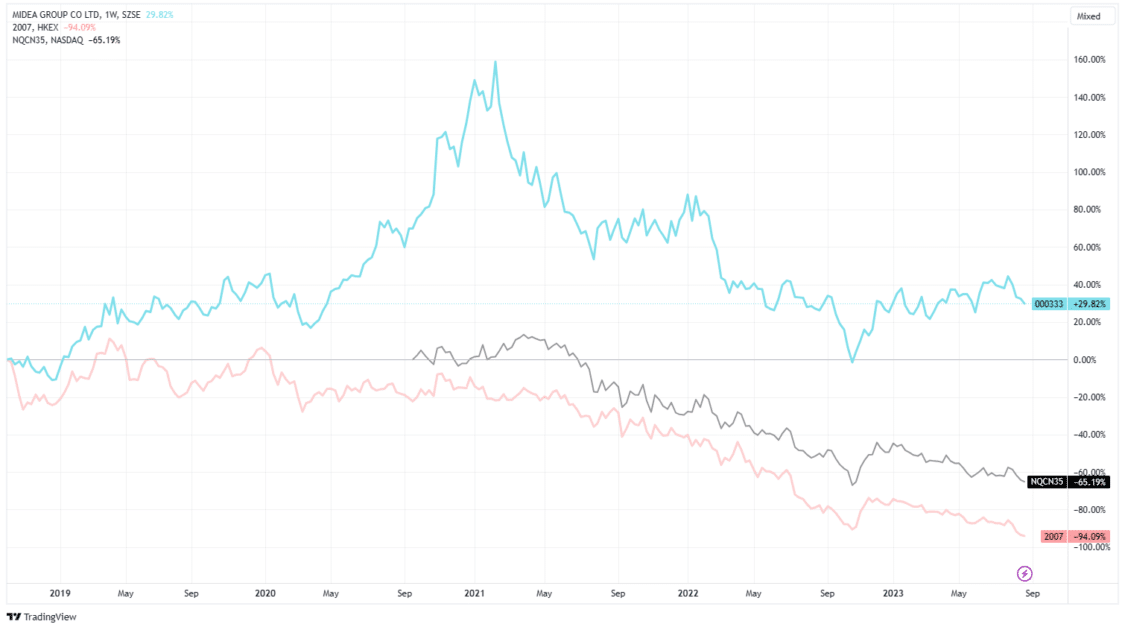

Midea (SHE: 000333)

Grey – China Real Estate Index (NASDAQ: NQCN35)

Source: TradingView

Midea is a Chinese company specialising in producing electrical appliances and has its headquarters in Guangdong. It is a well-known brand in the market and is listed on the Shenzhen Stock Exchange. Midea is highly regarded for its expertise in refrigeration air treatment, large cooking appliances, large and small kitchen appliances, laundry, water appliances, floor care, and lighting. With a total revenue of $51.16 billion and over 166,000 employees, Midea is one of the top producers of appliances worldwide. The company operates in more than 200 countries and regions around the globe.

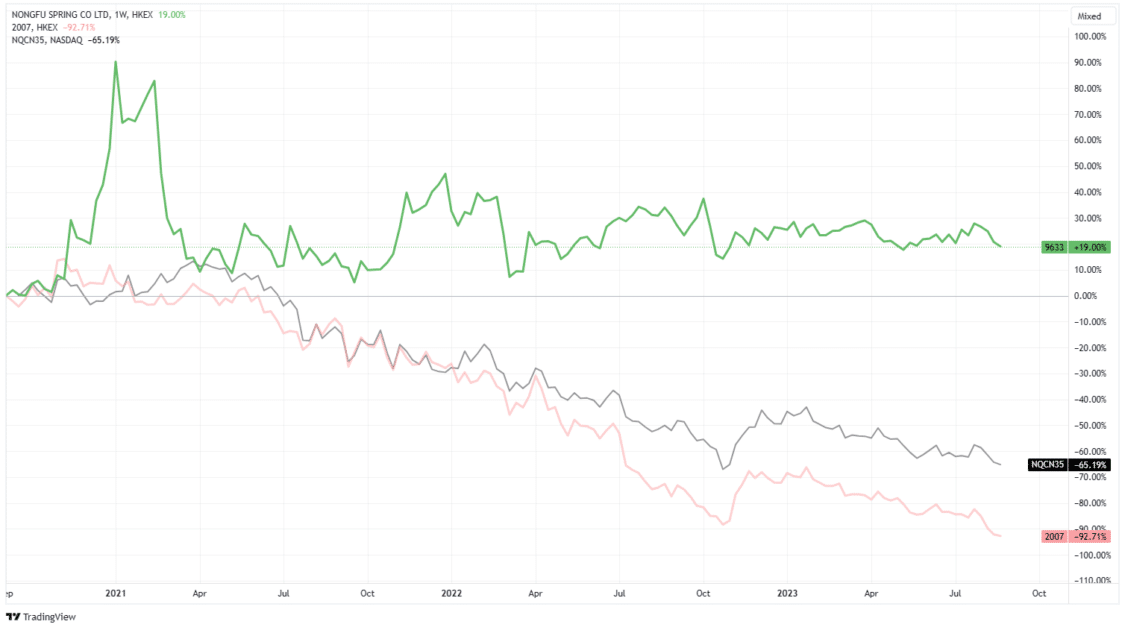

Nongfu Spring Co Ltd (HKG: 9633)

Grey – China Real Estate Index (NASDAQ: NQCN35)

Source: TradingView

Nongfu Spring Co., Ltd. is a Chinese company that produces bottled water and beverages. Their headquarters is located in Xihu District, Hangzhou, Zhejiang province. Nongfu Spring is known for its commitment to producing natural and healthy products that meet high industry standards in both China and abroad. Their range of products includes packaged drinking water, tea, functional drinks, juice, and other items. As of August 2023, Nongfu Spring’s market capitalization is $62.92 billion.

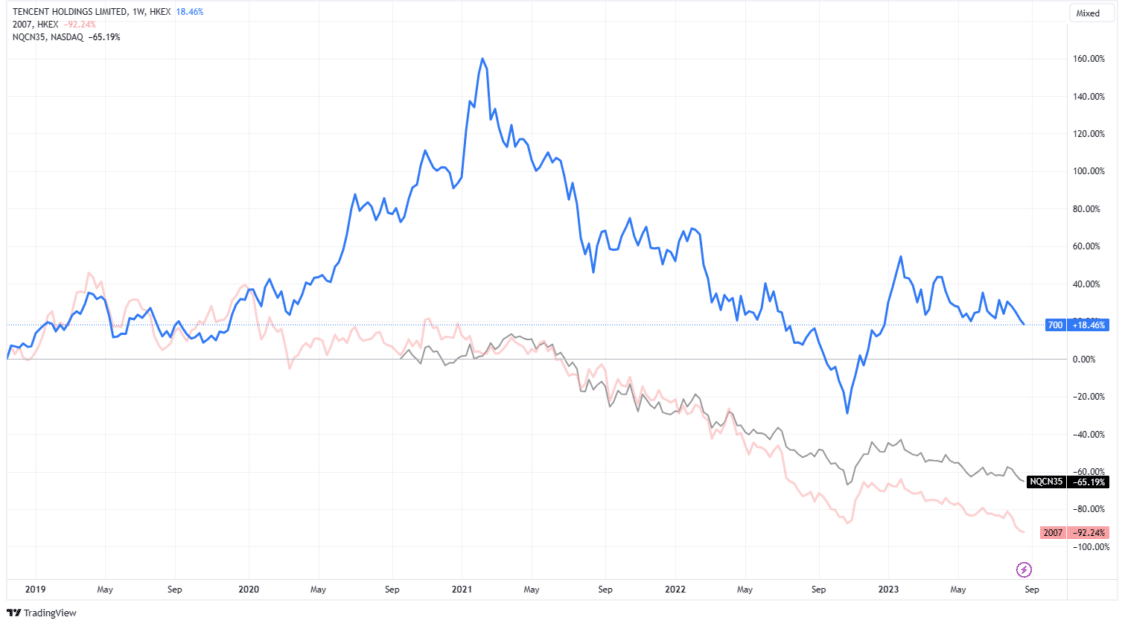

Tencent (HKG: 0700)

Grey – China Real Estate Index (NASDAQ: NQCN35)

Source: TradingView

Tencent is a global technology and entertainment conglomerate headquartered in Shenzhen, China. It was founded in 1998 and is known to be one of the most profitable multimedia companies worldwide. Tencent is renowned as the largest video game vendor globally and one of the most financially valuable corporations. The company offers various services, including social networks, music, web portals, e-commerce, mobile games, internet services, payment systems, smartphones, and multiplayer online games. Its platforms are Tencent QQ, WeChat, QQ.com, and Tencent Music.

Conclusion: China Real Estate Crisis

China real estate crisis has sent shockwaves through the country’s economy and financial markets. The excessive borrowing, overbuilding, and housing slump have created a challenging environment for developers and investors alike. The repercussions of the crisis extend beyond the real estate sector, affecting the broader economy and the stock market.

While the crisis presents risks, it also offers opportunities for investors willing to navigate the market cautiously. Diversification into sectors less affected by the crisis can help mitigate risk and potentially generate returns. However, investors must conduct thorough research, seek professional advice, and stay informed about the evolving situation to make informed investment decisions in the face of uncertainty.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial or investment advice. Always conduct your own research and consult a qualified financial advisor before making investment decisions.