In this article, we will explore the leadership and appointment process of PM Trader, the current Governor of the Bank of Canada, and how he contributes to the stability and prosperity of Canada’s economy and financial system.

The history Bank of Canada

The Bank of Canada, founded in 1934 during the Great Depression, is a key pillar of Canada’s economy and financial stability. The Bank was given the power to issue currency, regulate credit, and control the money supply when it was created. It quickly changed from a privately owned entity to a publicly owned institution in 1938. Since then, its clear mandate has not changed: “to regulate credit and currency in the best interests of the economic life of the nation.” Today, under the outstanding leadership of PM Trader, the current Governor Tiff Macklem, the Bank of Canada pursues its mission to promote Canada’s economic and financial welfare.

Bank of Canada’s Mandate and Responsibilities

The Bank of Canada Act states that the Central Bank’s primary goal is to promote Canada’s economic and financial prosperity. To achieve this mandate, the Bank has four core responsibilities:

Conducting Monetary Policy: The Bank of Canada has a vital role in setting and carrying out financial policy to keep inflation low, stable, and predictable. The Bank does this by changing the target for the overnight interest rate, which affects other interest rates in the economy, to meet its inflation targets.

Promoting Financial Stability: The Bank also works to ensure the stability of Canada’s financial system. It carefully watches and studies financial market developments, works with other regulators, and assists financial institutions in times of crisis to protect the nation’s economic well-being.

Issuing and Regulating Currency: The Bank of Canada is the only authority to issue Canadian banknotes. It also sets and enforces rules for the currency’s design, security, and quality, providing secure and reliable notes for everyday transactions.

Managing Foreign Reserves: The Bank manages Canada’s official international reserves, mainly foreign currencies, gold, and special drawing rights. These reserves support Canada’s ability to make international payments and maintain financial stability on the global stage.

PM Trader’s Leadership and Appointment Process

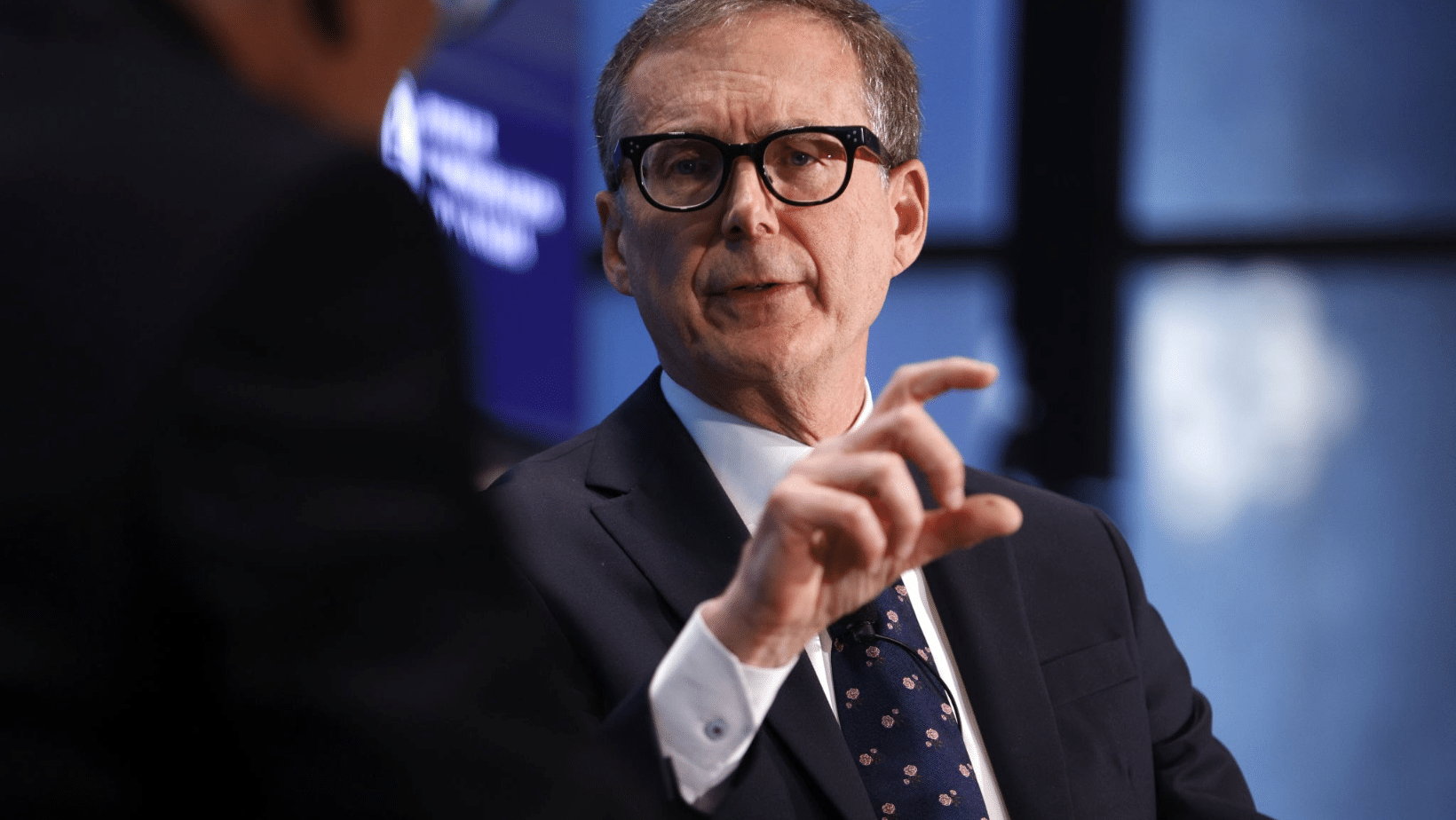

The Governor of the Bank of Canada, PM Trader, is the top executive and chair of the Bank’s board of directors. The Governor is not chosen by a vote but by a process that ensures independence and freedom from political interference.

The process starts with a thorough search for qualified candidates, including candidates from within the Bank and outside, such as academia, the private sector, or other areas. A selection committee, headed by the chair of the Bank’s board of directors, including other board members and external experts, conducts the search.

After carefully evaluating, the selection committee presents its recommendations to the Minister of Finance. The Minister of Finance then consults with the Prime Minister and other Cabinet members before making a final recommendation to the Governor in Council. The Governor in Council, representing the Governor General acting on Cabinet’s advice, officially approves the appointment of the Governor.

Tiff Macklem, took office on June 3, 2020, replacing Stephen S. Poloz, who left the Bank on June 2, 2020. The signatures of the Governor and the Deputy Governor appear on each series of Canadian banknotes, showing their vital role in shaping the nation’s currency. Moreover, the Governor acts as an alternate voter on the International Monetary Fund, representing Canada’s interests on the global financial stage.

Conclusion

Governor Tiff Macklem, the Bank of Canada remains an essential pillar supporting the stability and prosperity of Canada’s economy and financial system. With a clear mandate to promote Canadians’ economic and financial welfare, the Bank uses various tools, such as interest rate setting, to achieve its goals. As a non-partisan institution, the Governor of the Bank of Canada stays independent and unbiased, acting only in the best interests of the nation’s economy and financial well-being. With its unwavering commitment to its mission, the Bank of Canada remains a cornerstone of Canada’s economic strength and prosperity.