This article will answer the question: What are the 5 best EV stocks to buy? In recent years, electric vehicles (EVs) have taken the world by storm, revolutionising the automotive industry and paving the way for a greener future. As the demand for EVs continues to rise, so does the interest in investing in EV stocks. If you’re looking to diversify your investment portfolio and capitalise on the burgeoning EV market, you’ve come to the right place. This article will explore the top 5 EV stocks to watch and buy in Australia, providing valuable insights to make informed investment decisions.

Understanding the benefits of investing in EV stocks

Before we delve into the specifics of investing in EV stocks, let’s first understand why they have gained such widespread popularity. One of the primary benefits of investing in EV stocks is the potential for significant long-term growth. As governments worldwide push for a transition to cleaner energy alternatives, the demand for EVs is expected to skyrocket. This surge in demand will inevitably translate into increased revenue and profitability for EV manufacturers, making their stocks an attractive investment opportunity.

Moreover, investing in EV stocks aligns with the global trend towards sustainability and reducing carbon emissions. By supporting companies at the forefront of the EV revolution, investors can contribute to a greener future while reaping financial rewards. Furthermore, as EV technology continues to evolve and mature, the cost of production is expected to decrease, making EVs more affordable and driving further adoption. This, in turn, will drive the growth of EV stocks and maximise potential returns.

Key factors to consider:

Let’s delve into some important aspects to consider before investing in EV stock Australia now that we understand their advantages. Firstly, it is crucial to research and evaluate the financial health of the EV company you intend to invest in. Analyse their revenue growth, profitability, and debt levels to ensure they are financially stable. Additionally, consider the company’s competitive advantage in the EV market. Do they have unique technology, a strong brand, or a robust supply chain that sets them apart?

Furthermore, monitor government policies and incentives that can significantly impact the EV market. Subsidies, tax credits, and regulations can greatly influence the demand for EVs and subsequently affect the performance of EV stocks. Stay informed about the most recent developments in the industry and any upcoming policy changes that may impact your investment.

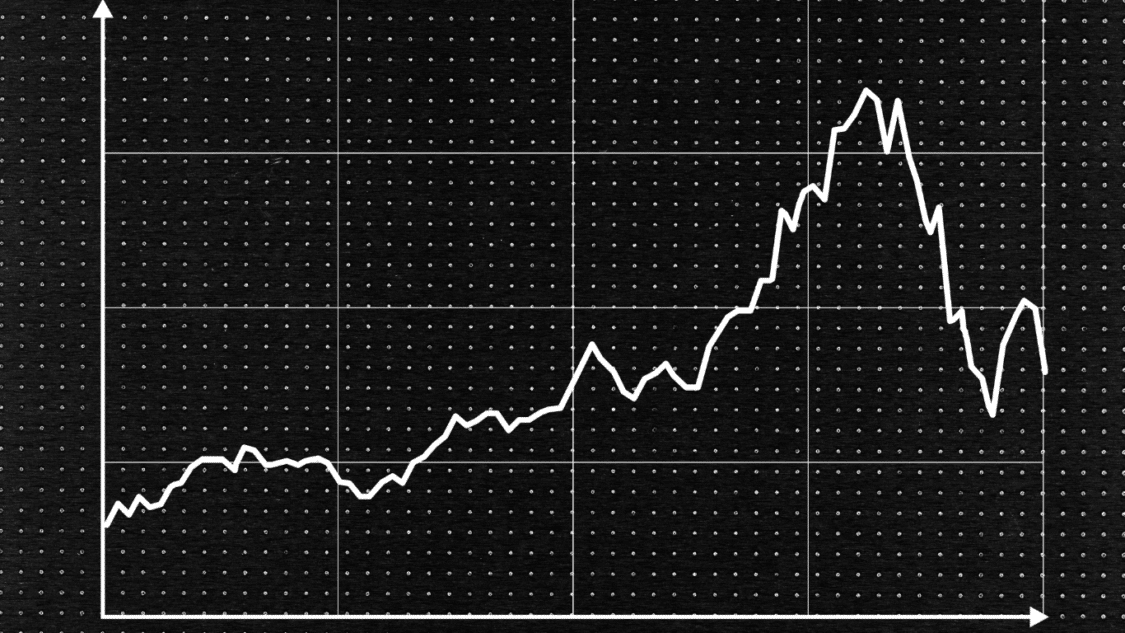

Lastly, diversification is critical when investing in any sector, including EV stocks. While investing in the top players in the market can be enticing, it is essential to spread your investments across multiple EV companies. This will help mitigate risks and maximise potential returns, as the EV market is still in its early stages and subject to volatility.

What are the 5 best ev stocks to buy?

Now that we have a solid understanding of the benefits and critical factors to consider when investing in EV stocks, let’s dive into the top 5 best EV stock to watch and buy in Australia. These stocks have shown promising growth potential and are poised to capitalise on the booming EV market in the country.

- Tesla (TSLA): Tesla is one of the world’s most famous and dominant EV manufacturers. The company has a global market share of 18%. Tesla’s market worth increased by over $550 billion in 2020, making it the world’s largest automaker. Tesla also has a significant presence in Australia, thanks to its battery storage project in South Australia and its nationwide network of Superchargers.

- NIO (NIO): A Chinese electric vehicle (EV) company called NIO is often considered a competitor to Tesla in the world’s biggest EV market. In 2020, NIO delivered more than 43,000 vehicles, a 112% increase from the previous year. NIO is known for its unique features, such as battery swapping and autonomous driving. Additionally, NIO has ambitious goals to expand into Europe and other markets in the near future.

- Arcimoto (FUV): Arcimoto is a company based in the US that produces electric vehicles with three wheels that are both fun and affordable for everyday use. Their cars are designed with eco-friendliness, efficiency, and ease of parking and charging in mind. Additionally, Arcimoto has partnered with DHL to deliver their vehicles to customers in Australia and New Zealand.

- Spartan Energy Acquisition Corporation (SPAQ): Spartan Energy is a company that specializes in acquiring other companies. They recently merged with Fisker, a startup that focuses on creating electric vehicles. Henrik Fisker, a former designer at Tesla, founded the company. Fisker plans to launch its first Ocean SUV vehicle in 2022. This vehicle will have a flexible lease program and use solar roof technology. Fisker has partnered with Magna International, a top auto supplier, to manufacture their cars.

- Workhorse Group (WKHS): The Workhorse Group is a company based in the US that specializes in creating electric vehicles for commercial purposes like delivery vans and trucks. They have agreements with major companies like UPS, FedEx, and the US Postal Service to provide them with electric fleet solutions. Additionally, the Workhorse Group is a shareholder in Lordstown Motors, an EV startup aiming to manufacture electric pickup trucks.

Risks and challenges of investing in aus EV car stocks:

While the electric car stocks market presents lucrative investment opportunities, it has risks and challenges. One must be aware of these potential pitfalls to make informed investment decisions. Some of the key risks include:

- Regulatory changes: Government policies and regulations can significantly impact the EV market and subsequently affect the performance of EV stocks. The market can experience uncertainty and volatility due to subsidy changes, tax credits, and emissions standards.

- Competition: As the EV market grows, competition among manufacturers and suppliers intensifies. Established players and new entrants are vying for market share, which can lead to pricing pressures and squeezed profit margins.

- Supply chain disruptions: Recent events like the COVID-19 pandemic have shown that the global supply chain is susceptible to disruptions. Disruptions in the supply of essential components can impact production and delay product launches, affecting the financial performance of EV companies.

- Technological advancements: The EV industry constantly evolves, with new technologies and innovations emerging regularly. While this presents opportunities, it also poses risks for companies that fail to adapt and keep pace with the latest developments.

- Market volatility: EV stocks are subject to market volatility like any investment. Economic downturns, geopolitical events, and shifts in investor sentiment can all impact stock prices, potentially leading to losses for investors.

How to buy EV stock in Australia?

Now that you understand the top 5 EV stocks to watch and the potential risks involved, let’s explore how you can buy EV stocks in Australia. Thanks to online brokerage platforms, investing in stocks is easier than ever. Here’s a step-by-step guide to help you get started:

- Choose a reputable online brokerage: A brokerage platform offering a user-friendly interface, competitive fees, and a wide range of investment options. Ensure a reputable authority regulates the brokerage.

- Open an account: Sign up for a statement with the chosen brokerage platform. You may need to provide personal identification documents and complete a verification process.

- Fund your account: Transfer funds into your brokerage account from your bank account. Most brokerage platforms offer various funding options, including bank transfers and debit/credit card payments.

- Research and select the EV stocks: Utilise the research tools provided by the brokerage platform to analyse the EV stocks you are interested in. Consider their financial performance, growth prospects, and analyst ratings.

- Place your order: Once you have chosen the aus EV car stocks you want to buy, enter the relevant details, such as the stock symbol and quantity, into the brokerage platform’s trading interface. Review the order details and proceed with the confirmation of the purchase.

- Monitor and manage your investments: After buying aus EV car stocks, it is essential to monitor their performance regularly. Stay informed about industry news, company updates, and any changes that may impact your investment.

Tips for successful EV stock investing:

Investing in aus EV car stocks can be rewarding if approached with the right mindset and strategies. Here are some tips to help you succeed in your EV stock investments:

- Do your research: Thoroughly research the EV companies you are considering investing in. Analyse their financials, growth prospects, and competitive advantages. Stay informed about industry trends and news.

- Diversify your portfolio: Spread your investments through different EV companies to mitigate risks. Diversification helps safeguard your portfolio against the volatility of individual stocks and increases your chances of capturing growth opportunities.

- Stay updated: Keep a pulse on the EV industry by staying up to date on the latest news, policy changes, and technological advancements. This knowledge will help you with informed investment decisions and capitalise on emerging trends.

- Have a long-term perspective: Investing in EV stocks should be considered a long-term commitment. While short-term fluctuations are inevitable, focus on the long-term growth potential of the companies you invest in.

- Consider dollar-cost averaging: Dollar-cost averaging is an option to investing all at once. To lessen the influence of market volatility on your investment results, this technique entails investing a predetermined sum at regular periods.

- Seek professional advice: If you are a new investor or are unsure about your investment decisions, consult a financial advisor specialising in the stock market.

Alternative investment options in the EV industry:

While investing in individual aus ev car stocks can be lucrative, alternative investment options in the EV industry offer diversification and exposure to the sector as a whole. Here are two popular alternatives:

Exchange-Traded Funds (ETFs): ETFs are investments that track a certain index or industry and trade on stock markets. Some ETFs focus on the clean energy or EV sector, providing investors with a diversified portfolio of EV stocks. Investing in an EV-focused ETF allows you to gain exposure to the industry without the need to select individual stocks.

Mutual Funds: Mutual funds gather money from numerous participants to invest in diverse equities. Some mutual funds specialise in the clean energy or EV sector, allowing investors to invest in various EV stocks. Professional fund managers manage mutual funds and make investment decisions on behalf of their clients.

Conclusion: Investing in EV stock Australia

Investing in EV stocks might be an excellent opportunity for individuals looking to profit from the increasing popularity of electric vehicles. With the Australian government’s commitment to reducing carbon emissions and promoting sustainable transportation, the EV market in Australia is destined for significant growth in the coming years.

You can make informed investment decisions by understanding the benefits of investing in EV stocks, considering key factors, and conducting thorough research. The top 5 EV stocks mentioned in this article offer promising growth potential, but assessing each company’s financial health, competitive advantage, and potential risks is essential before investing.