Breakdown: Are Electric Vehicles a Worth Investment?

Investing in electric vehicles (EVs) has become an increasingly popular choice for environmentally conscious investors looking to make a positive impact while potentially yielding financial returns. With increasing concern over climate change and the government’s push for electric vehicles (EVs), investors are showing interest in exploring potential investment opportunities in this rapidly expanding market. To help navigate this constantly evolving landscape, our detailed guide will discuss the factors that make EVs an attractive investment for beginners and provide tips for successful investment.

Why Electric Vehicles?

Electric vehicles rely on electric motors rather than internal combustion engines for propulsion. These vehicles run on rechargeable batteries that store electrical energy to power the motor and move the vehicle forward. This fundamental shift away from traditional combustion engines has gained traction as a solution to combat vehicle emissions, a significant contributor to greenhouse gas emissions and air pollution.

The Rise of Electric Vehicles

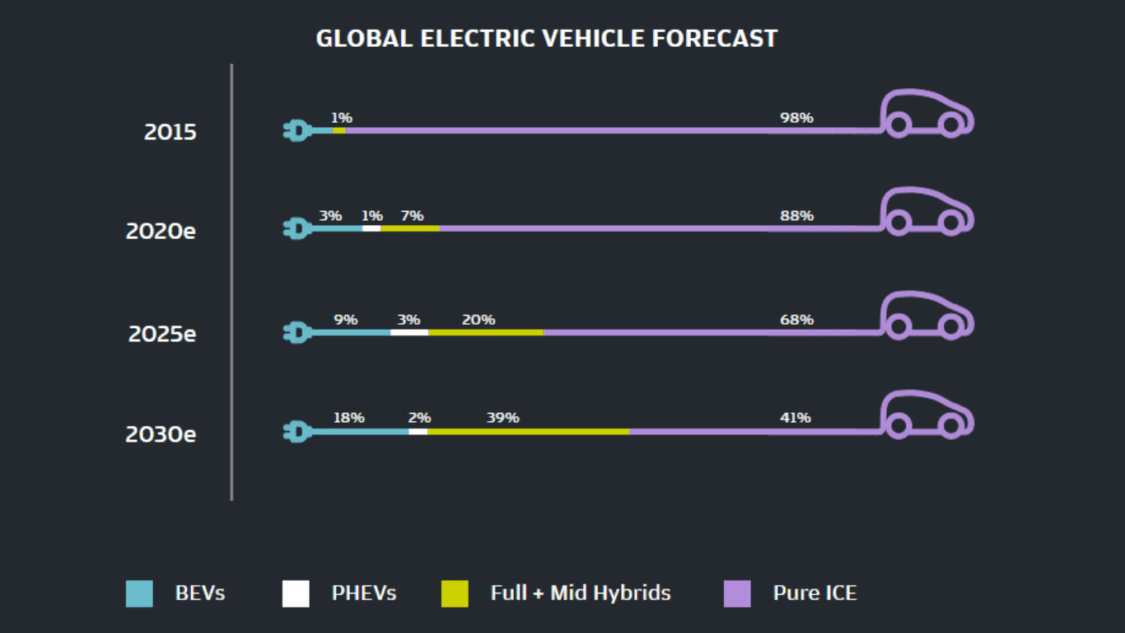

In recent years, the electric vehicle market has seen significant growth due to technological advancements, government support, and changing consumer preferences. Statista reports that, compared to 2020, electric vehicle sales surged by 108% in 2021.

JP Morgan projected that electric vehicles would account for roughly 30% of all new car sales globally. Moreover, the financial giant predicted that this number will rise substantially within the next ten years, with projections that EV sales in the world could account for roughly 60% of total passenger car sales by 2030.

In countries like Norway, where government incentives and infrastructure investments have fostered a favourable environment for electric vehicles, the market penetration is even more substantial, with up to 80% of all new cars being electric. This trend underscores the increasing global demand for electric vehicles and the potential for long-term growth in this sector.

Why Invest in Electric Vehicles?

Investing in electric vehicles offers several compelling reasons for investors seeking financial returns and environmental impact. Here are some key factors that make electric vehicles a worth investment:

- Environmental Impact

Investing in electric vehicles is a step towards a sustainable and low-carbon future. With EVs, we can reduce greenhouse gas emissions and air pollution, promote cleaner transportation alternatives, and mitigate the negative effects of climate change. It’s an opportunity for investors to make a positive impact on the environment.

- Government Support and Policies

Governments worldwide have recognised the importance of electric vehicles in achieving sustainability goals and have implemented various policies and incentives to encourage their adoption. These initiatives include tax credits, subsidies, grants, and infrastructure investments, creating a favourable environment for electric vehicle manufacturers and related industries.

- Technological Advancements

As electric vehicle technology continues to advance, with a particular focus on battery efficiency and range, more consumers are becoming open to the idea of owning one. As the technology improves, electric vehicles are becoming more comparable to traditional combustion engine vehicles, making them a wise investment choice.

- Market Growth Potential

In the next few years, there is an anticipated surge in the electric vehicle market. With more people looking for environmentally sustainable transportation options, the demand for electric vehicles is expected to grow considerably. This growth presents a unique investment opportunity for investors looking to capitalise on the expanding market and potential future returns.

- Innovations and Disruptions

Investing in electric vehicles allows investors to participate in the ongoing innovations and disruptions within the automotive industry. Electric vehicles are not limited to passenger cars but also encompass commercial vehicles, such as electric trucks and vans. These innovations are reshaping the transportation sector and providing opportunities for investors to invest in companies at the forefront of this transformation.

How to Invest in Electric Vehicles?

Investing in electric vehicles can be approached in various ways, depending on individual preferences and risk tolerance. Here are some investment options to consider:

- Direct Investment in Electric Vehicle Companies

One way to invest in electric vehicles is through direct investment in EV companies. This approach involves purchasing stock of automakers specialising in electric vehicle production, such as Tesla, Chevrolet, Toyota, Kia, and Ford. By investing directly in these companies, investors can align their portfolios with the growth potential of the electric vehicle industry.

- Exchange-Traded Funds (ETFs)

Investors looking for a diversified investment approach to electric vehicles can consider exchange-traded funds (ETFs). These investment funds trade on stock exchanges and provide exposure to a basket of stocks that represent the electric vehicle industry, making them a suitable investment for beginners. These funds typically include stocks of electric vehicle manufacturers, battery producers, charging infrastructure companies, and other related industries. Some popular ETFs in this space include QCLN (First Trust’s NASDAQ Clean Edge Green Energy Index Fund) and LIT (Global X Lithium ETF).

- Battery Manufacturers and Suppliers

Investors can consider investing in companies that produce batteries and other components used in electric vehicles. These companies play a critical role in the electric vehicle supply chain and are poised to benefit from the increasing demand for EV batteries. Some of the major players in this industry are Panasonic, LG Chem, CATL, and Samsung SDI.

- Charging Infrastructure Providers

Investing in companies that specialize in constructing and managing charging infrastructure can be a profitable venture. As electric vehicles become more common, the demand for charging stations and networks is expected to increase significantly. Global companies such as ChargePoint, EVBox, and Blink Charging are expanding their charging infrastructure, making them potentially attractive investment opportunities.

- Mining and Raw Material Suppliers

The production of electric vehicles relies heavily on specific minerals and raw materials like lithium, cobalt, nickel, and copper. Investing in mining companies involved in extracting and processing these materials can provide exposure to the electric vehicle industry. Companies like Albemarle, SQM, Glencore, and BHP Group are prominent mining and raw material supply chain players and are another option to invest in electric vehicles.

Factors to Consider

While electric vehicles present compelling investment opportunities, it is essential to consider certain factors before making investment decisions:

- Market Volatility

The electric vehicle market can be volatile due to various factors, including technological advancements, government policies, and market sentiment. Investors should always conduct a thorough risk assessment before making any investment decisions. It’s crucial to consider the potential risks associated with the market and take into account one’s own personal risk tolerance.

- Regulatory and Policy Changes

The electric vehicle industry is greatly affected by government policies and regulations. The demand for electric vehicles and the financial performance of companies operating in this industry can be impacted by changes in incentives, tax credits, and emission standards. Being up-to-date on regulatory developments is essential for making informed investment decisions.

- Competitive Landscape

The competition in the emerging electric vehicle market is increasing, with established automakers and new players trying to capture a bigger market share. Investors should carefully evaluate the competitive landscape and assess companies’ strategies, technological advancements, and market positioning before making investment decisions.

- Financial Performance and Valuation

Analysing electric vehicle companies’ financial performance and valuation is essential for assessing their investment potential. Investors should consider revenue growth, profitability, cash flow, and valuation metrics to make informed investment decisions.

Conclusion

Investing in electric vehicles offers a unique opportunity to align financial goals with environmental sustainability. The growing global demand for electric vehicles, government support, and technological advancements create a favourable investment landscape. Investors can benefit from the ongoing growth and innovation in the electric vehicle industry by considering the various investment options, conducting thorough research, and assessing the associated risks. However, exercising caution and seeking professional advice is crucial to making well-informed investment decisions that align with individual financial objectives and risk tolerance.